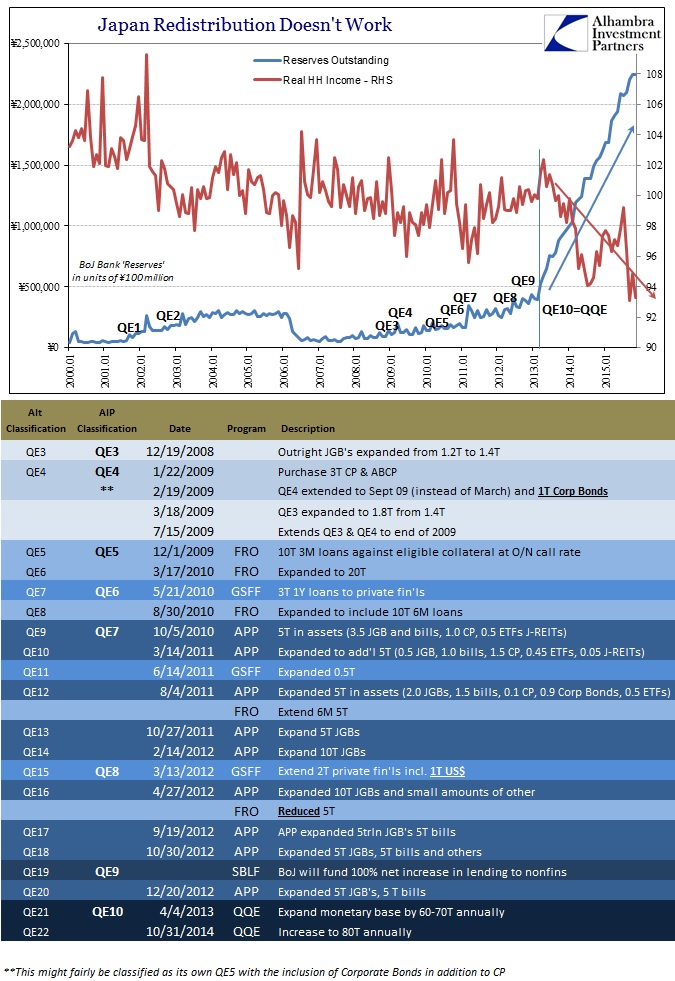

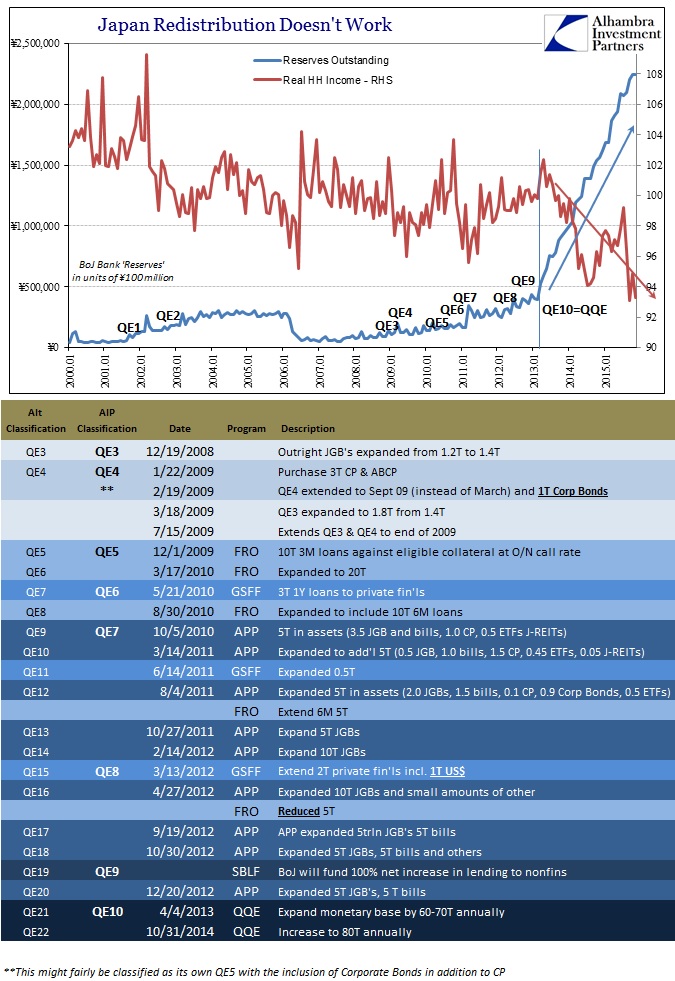

At what point do we accede back to logic and rational thought? The Bank of Japan is “forced”, not my word, to unleash negative nominal interest rates and that is taken as a positive for everyone everywhere. Such a move is, without question, an open admission that QQE failed and failed spectacularly (since it was even expanded not really that long ago). That is cause for celebration and optimism?

Bloomberg tells us that a grim January gets to now end on a high note (that was the article’s title, after all) without ever pausing to consume the fact that January was so grim to begin with because nothing central banks do actually matter beyond the very short run.

U.S. stocks joined an advance in global equities, while bonds rallied as the Bank of Japan’s unexpected monetary stimulus boosted confidence that central banks remain vigilant of slowing economic growth. The yen tumbled, while oil gained.

The story performs the usual magic trick of semantics in favor of a positive reinforcement on the central bank activity; “central banks remain vigilant”, as if vigilance is all that is required or offered. It is neither. In the Bank of Japan’s case, what was delivered was supposed to be an enormous monetary wave of such fury and power as to leave no doubt as to how this was going to end. In April 2013, BoJ officials were so confident that they even provided a timetable for its expected completion – sustainable 2% inflation by the middle of 2015 (the end of 2015 if “unforeseen” problems developed).

Because inflation is taken as a signal of a healthy economy, that was all that was thought necessary. It obviously wasn’t, since not only was there a striking and deep recession in the middle of 2014 for Japan (which was and is blamed, wrongly, on the tax alteration) the BoJ actually scaled up QQE later that year.

The initial conditions for QQE in April 2013 were questionable, but central bankers remained undeterred; going so far as to vow to keep doing QE in its last format until it worked.

Former investment-bank economists Takahide Kiuchi and Takehiro Sato, who joined the board last year, opposed today’s statement that inflation is likely to reach 2 percent in the latter half of the three-year BOJ forecast horizon, Kuroda told reporters at a press briefing today. He said he personally thinks the goal will be achieved in the 2015 fiscal year.

Kuroda said that no board member judged that additional easing was needed now, and that policy adjustments would be made if necessary. The bank will keep its stimulus until stable 2 percent gains in consumer prices are realized, he said.

Leave A Comment