Sometimes it’s dangerous to stick out from the crowd. As traders, it’s a near necessity to have at least somewhat of a contrarian mindset, but you also have to know when to blend in with the environment if you ever want to survive. But even if you’re riding in a strong trend, you have to question when it might end. You have to manage your risk and you have to adjust your stops regardless of how strong the move is, or else even your best laid plans will prove ruinous. But when we can find a trend, or perhaps more accurately described as a ‘theme’ in a market, well that’s something that we can plan around.

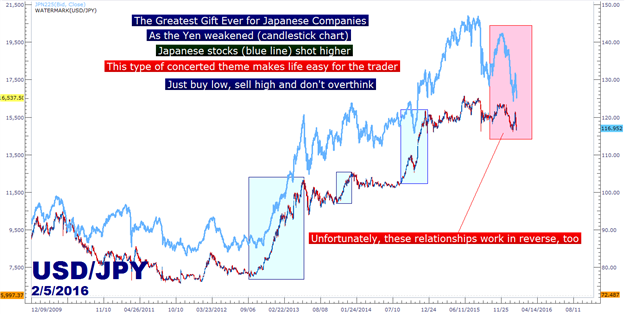

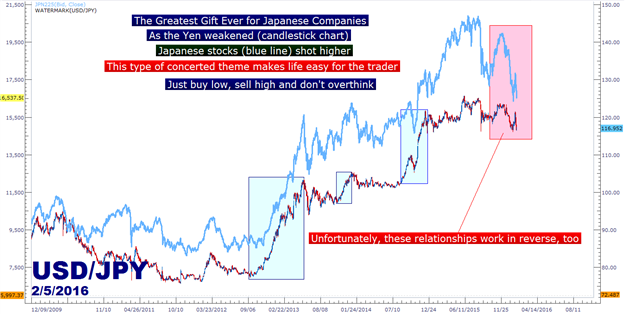

A good example of this was Abe-nomics coming to play in Q3 of 2012. As Shinzo Abe took power in Japan and brought with him an aggressive plan of economic revitalization, the Yen weakened massively on the expectation of a massive QE program. This also brought the Nikkei higher, and for the better part of 3 years those trends in the Yen and the Nikkei remained strong and traders could simply wait for a pullback, load up the position, and scale out as price action moved in their favor. Wash, rinse and repeat. These types of trends can make the trader’s life a lot easier because analysis can be reduced to ‘buy low, sell high.’

Chart 1: A Weak Yen Provided a Huge Boost to Japanese Stocks

Created with Marketscope/Trading Station II; prepared by James Stanley

Unfortunately, it doesn’t always work this way. But when it does, you can bet that hedge fund managers around the world can hardly contain the drool from dropping on their keyboards. It just makes life as a trader or portfolio manager that much easier. It looked like we may have one such trend as we came into this week, as much of the world was bracing for an impact of a slowdown or a recession, and there was one notable exception that was sort of ‘sticking out’ in the market. And that was the Fed’s continued expectation to continue raising rates while much of the world is looking at ways to lower their own.

And this brings up the real issue for global markets right now: At its lowest common denominator the problem that the world has been unable to solve that’s been brewing all along is a currency problem. Devaluations are getting more and more competitive, and Mr. William Dudley of the New York Fed tipped his hand this week when he said that continued strength in the US Dollar threatened the prospect of a continued recovery in the world’s largest national economy.

Most major economies, right now, are looking at ways to avoid capital flows into their currency. A strong currency means weakness in trade. If the value of the Yen moves up by 20% against the US Dollar, well Toyota is getting back 20% less for every car they sell in the United States. They did nothing wrong here and yet they’ll still get hit by 20%; and it’s just because of the USD/JPY spot rate. So analyze Toyota all you want, look at their EPS growth and market share – it’s all pointless if the Yen strengthens by 20% because people will likely not purchase a Toyota for 20% more and Toyota likely can’t go and just cut 20% of its budget to protect its margin (especially with Japan’s onerous labor laws and lifetime employment offered by many companies in the heyday of the 80’s); so like it or not Toyota (or other Japanese exporters) will probably take a hit.

Leave A Comment