The conventionally reported trade balance (or “net exports”) for the United States from the National Income and Product Accounts (NIPA) is net exports of goods and services, in nominal terms. (There are also trade balance measures on a Census basis and Balance of Payments basis, which differ in coverage and definitions.) The inflation adjusted trade balance is hard to calculate correctly, given the use of chain weighted measures of exports and imports. Here I plot a (Törnqvist) approximation to the real trade balance.

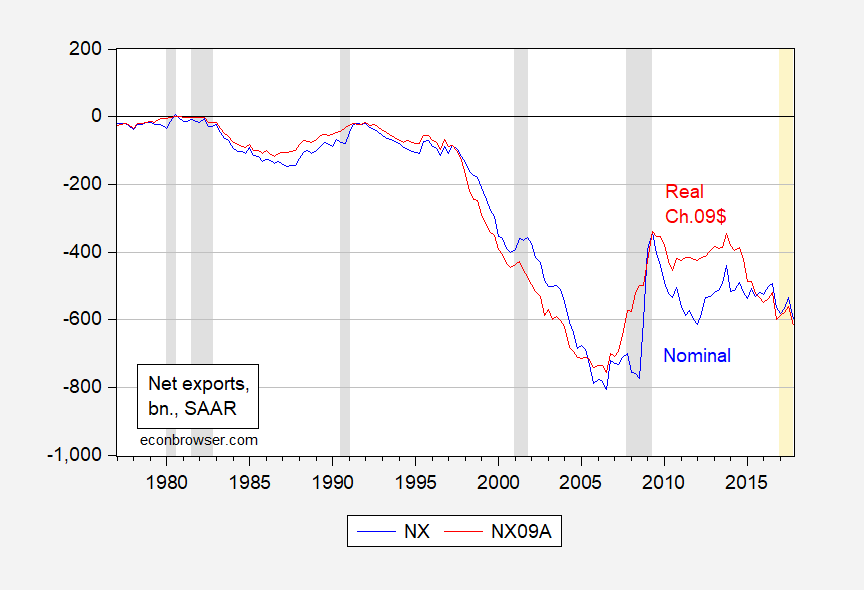

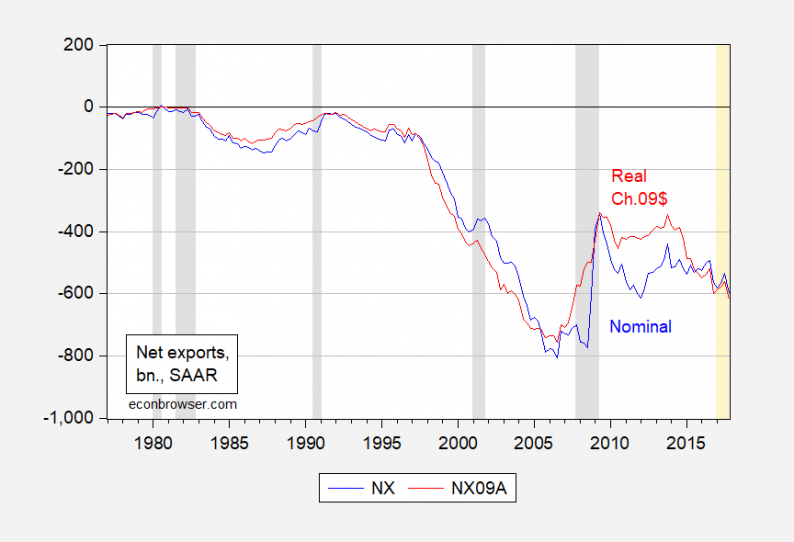

Figure 1: Net exports in billions of US$ (blue), and in billions of Ch.2009$ (red), SAAR. NBER defined recession dates. Orange denotes 2017Q1 onward data. Source: BEA 2017Q4 second release, and author’s calculations.

Notice both in nominal and real terms, net exports have deteriorated over the year 2017. This development is consistent with the picture in Figure 2.

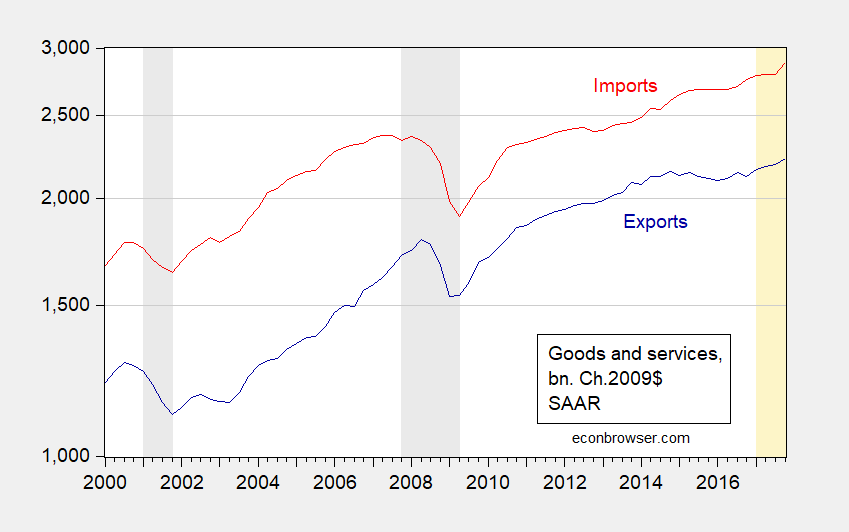

Figure 2: Real exports of goods and services (dark blue), and imports (dark red), in billions of Ch.2009$, SAAR, on log scale. NBER defined recession dates. Orange denotes 2017Q1 onward data. Source: BEA 2017Q4 second release.

What about net exports for the year? From Deutsche Bank US Economic Notes (23 March 2018):

With respect to the latter, Wednesday’s advance trade goods balance (-$76.0 bn vs. -$74.4 bn) for February will provide key data on the trends in the external sector. While we had expected net exports to contribute meaningfully to current-quarter real GDP growth after subtracting -113 bps from Q4, this looks increasingly unlikely as imports appear to be vastly outpacing exports. Case in point, based on the port statistics available for February, imported containers are up 11.3% month-on-month (seasonally adjusted), while exports are up only 1.6%.

One might think that applying tariffs would tend to reduce the net exports deficit. In partial equilibrium — if tariffs applied to a substantial portion of imports and all else remained constant — that conclusion would make sense. However, to the extent that planned national saving and investment drive the developments in financial flows to the US, income, production and exchange rates are likely to adjust in ways that offset relative price changes induced by tariffs.

Leave A Comment