The short-term flipped to an uptrend yesterday.

I will wait until Saturday to review the medium-term, but 11 of the 47 ETFs that I track closed at new highs today. So, it is hard to make the case that the current medium-term market trend is negative

This chart of the institutional index looks like it is headed higher again. Most of the other major indexes have a similar look in their charts.

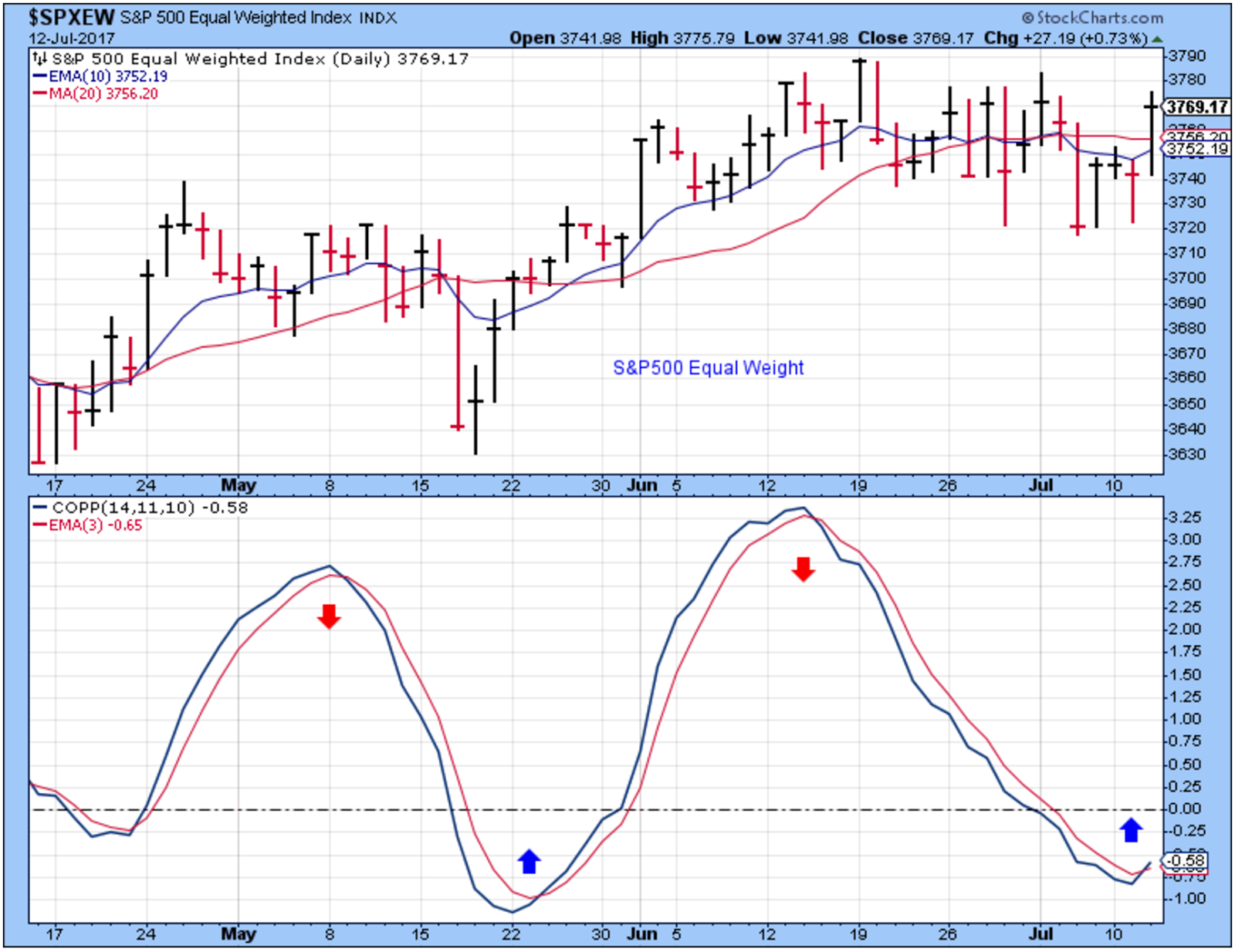

This chart does a decent job showing the short-term trend.

The Leader List

Emerging Market ETFs are red hot. Technology and Momentum stocks are regaining their strength. Materials look like they could be a leader again soon.

It was a broad-based rally today, and there wasn’t much weakness.

This is an ETF of the hottest small cap momentum stocks.

Semiconductors look to be headed higher again which is also a good sign for the broad market.

There isn’t much to dislike about this chart of Materials.

Outlook

The long-term outlook is positive.

The medium-term trend is … not sure.

The short-term trend is up as of July-12.

Leave A Comment