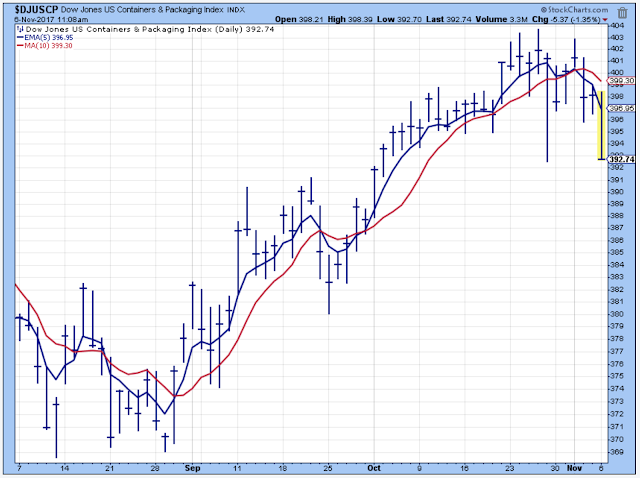

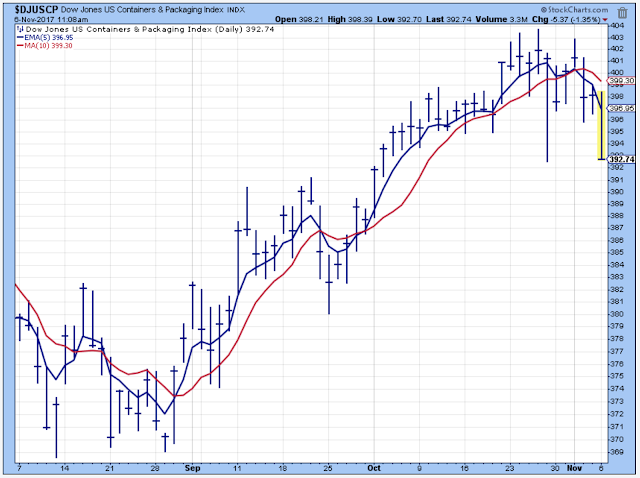

The SPY hit a new high today, but other market indicators were weak such as this group shown below. This index tends to move in sync with the short-term general market cycle which is currently a downtrend. However, it is difficult to say the general market is experiencing a short-term downtrend while the major indexes are reaching new highs.

My go-to indicator in a situation like this is the number of new 52-lows, and this indicator is still a bit too elevated to call a new short-term uptrend.It doesn’t really matter though. If you are the right areas of the market, you are making money and vice versa.

Investors are probably breaking off into two camps… some who feel the market is getting frothy, and others who are jumping on board.

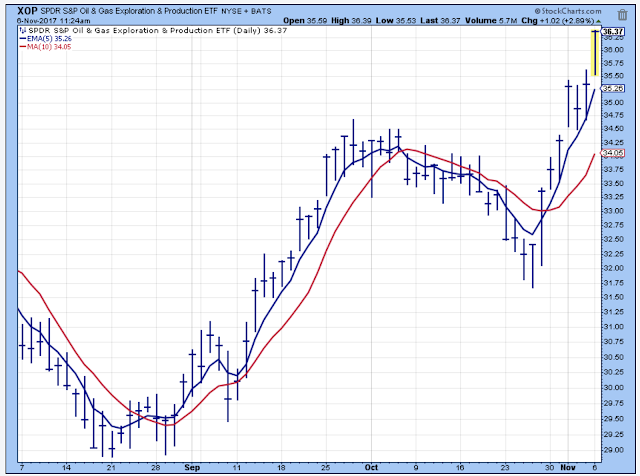

If you bought this group when it was down, then you were smarter than me. Very nice.

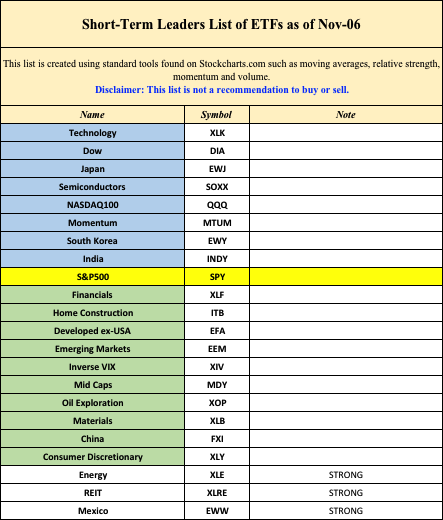

The Short-Term Leader List

The strongest ETFs are blue, the additional leaders are green and the weakest are red. The S&P500 is the benchmark. Disclaimer: This list is not a recommendation to buy or sell.

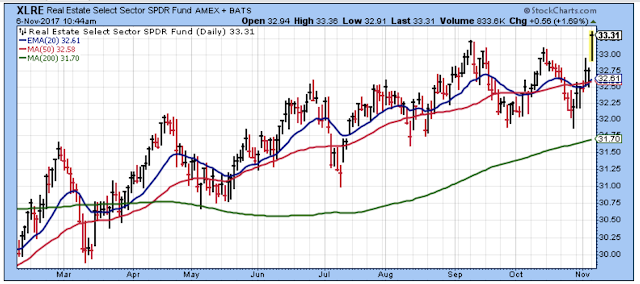

New highs for this group of stocks. My inclination is to think that this group is moving higher as a defensive measure by some investors who are starting to take profits in the high momentum stocks. Longer-term interest rates have been moving lower recently, while short-term rates have been moving higher, and that helps this group too.

I think NAFTA negotiations have been hurting this ETF. Maybe it has become so oversold that buyers are stepping in. Stronger oil prices are probably helping as well.

Outlook

The ECRI index has bottomed out and is pointing higher, however, weak M2 growth is a concern.

The long-term outlook is improving.

The medium-term trend is up. The best period for buying is past.

The short-term trend is down.

Leave A Comment