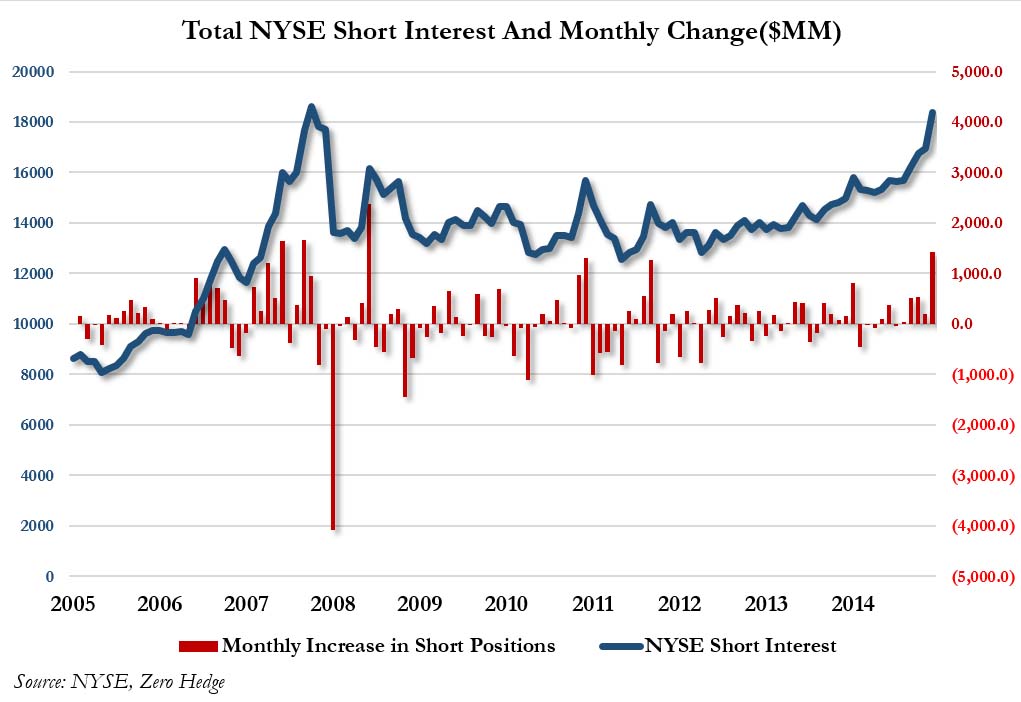

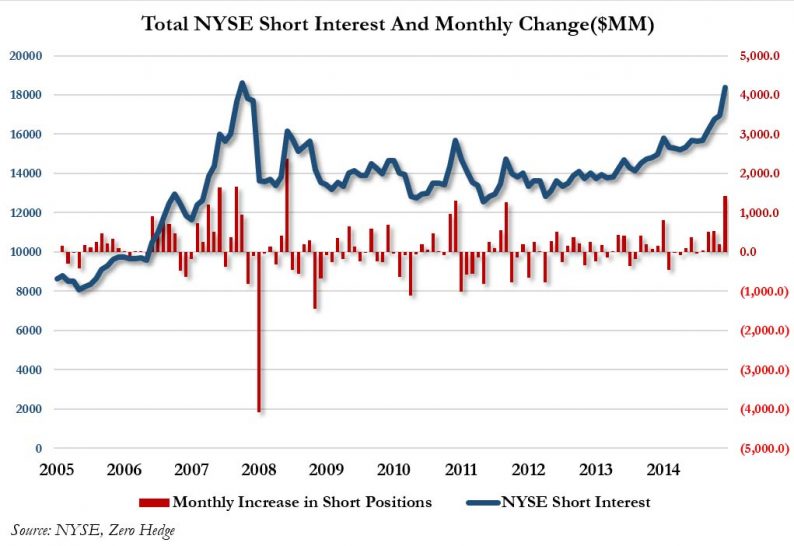

Several weeks ago, we observed that in the aftermath of the volatility surge in the late summer, NYSE short interest had soared to what was essentially the highest level on record, rising above 18.3 billion shares matching with the level reached just before the great financial crisis was unleashed in 2008.

We said there are two ways of looking at this extreme in bearish sentiment:

We concluded by saying that “the correct answer will be revealed in the coming weeks.”

Indeed, just two weeks later, we got confirmation that the violent explosion in the S&P500 to the upside (rapidly approaching all time highs yet again), was “Not A Risk-On Rally, But The Biggest Short Squeeze In Years” one which was catalyzed by a plunge in the USD as conventional wisdom shifted violently (orwhiplashed, as SocGen poetically said) from a rate hike (being good news) to a continuiation of zero interest policies (being even better news).

So where are we now?

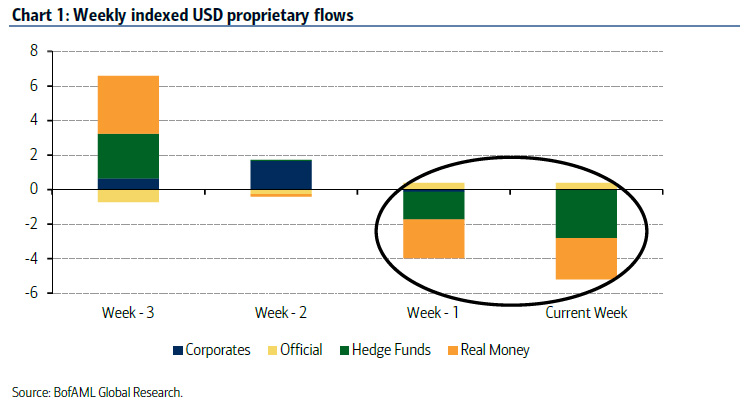

According to a cross-border flow update by BofA “risk-on flows for the 2nd week, but the positioning squeeze has now run its course and the market is short USD for the year.”

BofA’s Athanasios Vamvakidis, who just ten days ago was channeling this website when he said that “We Should Have Known Something Was Wrong”, adds the following detail:

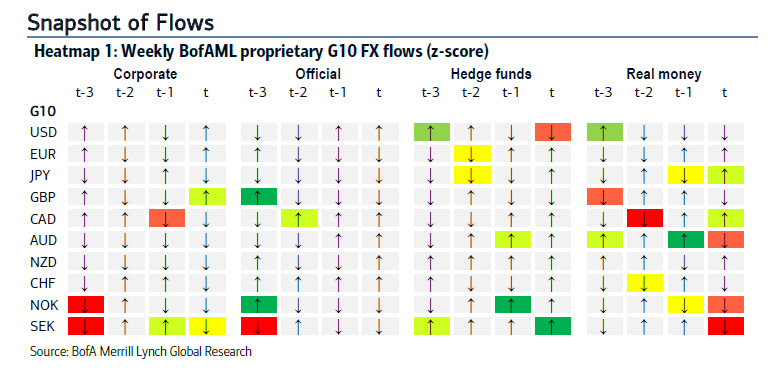

The squeeze of long USD/short risk positions continued for a second week, according to our proprietary flows through Friday October 16 (Chart 1 and Heatmap 1). Hedge funds sold USD against high beta currencies in G10 and EM last week. Real money flows were mixed in G10, but mostly positive in EM.

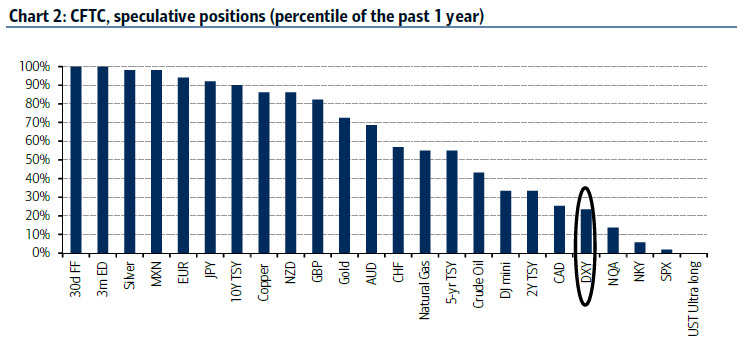

This positioning squeeze should have now run its course. Both positioning analysis based on our proprietary flows and the CFTC data suggest that the market is now short USD and long risk for the year (Chart 2).

The EPFR data also reflected two-way flows in the week ending October 14. This evidence suggests more balanced risks looking forward.

Leave A Comment