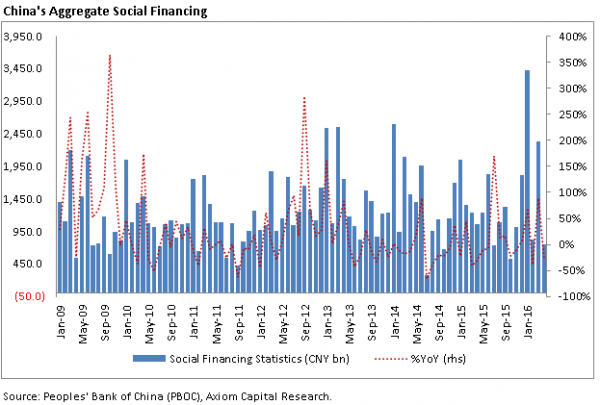

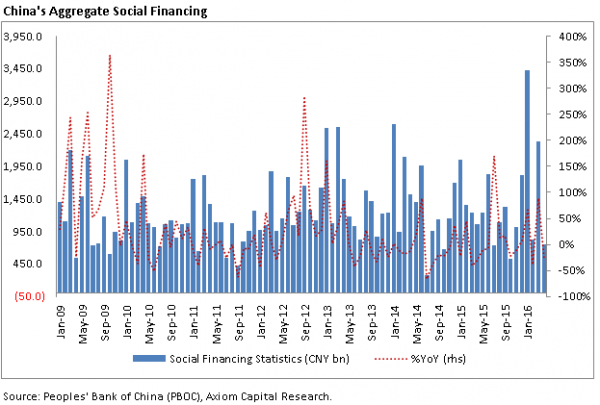

Just over a week ago, we pointed out that China’s great credit growth stimulus from early 2016, when the PBOC injected $1 trillion in new credit in the first quarter of the year, had come to a screeching halt in April, confirmed by the lack of growth in China’s broadest credit aggregate, Total Social Financing, which had just dipped to a negative growth print year-over-year.

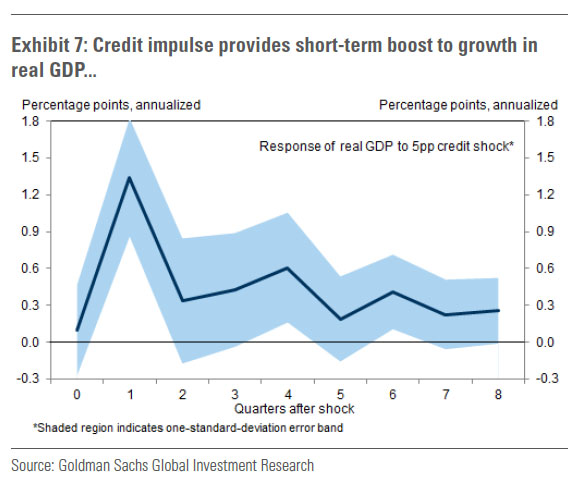

While there were various important implications from this substantial Chinese slowdown, we concluded that the biggest concern for China, and the world, is that “now that China’s credit impulse is gone, it means that the it is only a matter of time before the impetus behind Chinese, and global growth, evaporates as per the timeline presented in the following Goldman chart, which explained the surge in Q1 economic activity, and which now anticipates a steep slowdown in the second and subsequent quarters unless China manages to stoke its unsustainable credit growth once again.”

To be sure, the CNY64 trillion question is how long before the market prices in this imminent slowdown.

According to a just released, very bearish note by Morgan Stanley’s chief cross-asset strategist Andrew Sheets, which picks up on the risk factors unleashed by China’s dramatic slowdown the recent pick-up in global growth is temporary, and flags “greater risks that the slowdown arrives even sooner than August.” But most importantly, when looking at when the market will price in the next Chinese slowdown, Sheets says that “our China economic activity indicator (MS-CHEX) is at 3% versus 10% last month, while property sales in top cities have slowed to 15%Y in the first two weeks of May compared to 55%Y in April. If we think China growth softens again over the summer, the question for markets is how far ahead of this prices react.”

His conclusion: “the risks are rising that the time is now.”

Here is Morgan Stanley’s full note on “Timing China’s Mini-Cycle”

Leave A Comment