With the US stock market near its all-time high and having a solid year, it’s easy to miss out on the global growth deceleration. The global economy is by no means terrible, but it has seen deceleration as the global synchronized growth narrative disappeared, with emerging markets feeling a significant burden from the new reality.

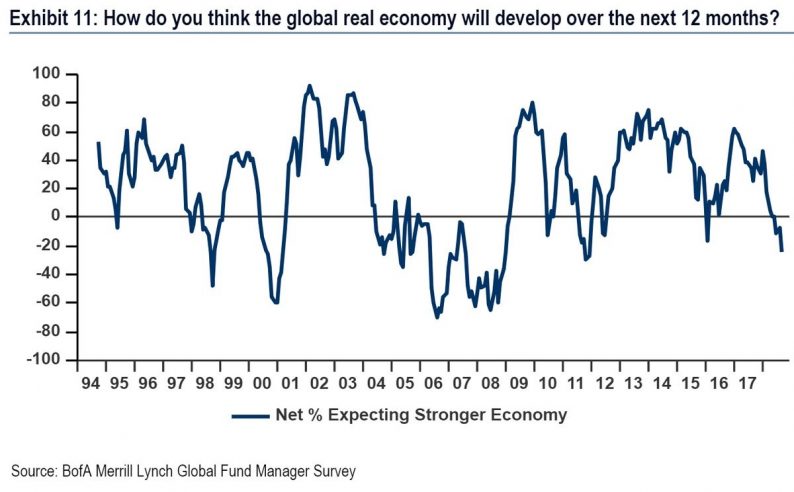

The chart below shows the Bank of America Merrill Lynch fund manager survey.

Source: Merrill Lynch

The net percentage expecting improvement in global real growth in the next 12 months is the weakest since late 2011/early 2012 when it briefly fell because of the sovereign debt crisis centered in Europe. Optimism is even worse than late 2015/early 2016 when many feared America was about to fall into a recession and Brazil was in the midst of a depression. Sometimes mini shocks to the system have made fund managers look late, but they were correct to be mostly bearish on the global economy for the next year from 2006 to 2008.

The JP Morgan Global Services PMI and Global Composite PMI show growth slowed in August like we’ve described.

Source: Services PMI

Rate of change is important when studying economics. It’s worse to go from great growth to good growth than okay growth to bad growth because there’s more room to decline because expectations are higher in the first case. The Global Composite output fell from 53.7 to 53.4. While this doesn’t seem terrible, 4 of 6 components fell and the trend has been lower ever since the peak in early 2018. There were similar results in the August JP Morgan Services index as output fell from 54 to 53.5 and 3 components fell, 1 was flat, and 2 improved.

Trade War Is Here

It was once promised by the White House that after one trade deal was done, others would come easier. However, the reverse has occurred. After the deal with Mexico, a deal with Canada hasn’t been struck and tensions have escalated with China. The tariffs have impacted specific commodities such as metals, but haven’t impacted consumer prices enough to increase overall inflation. The catalyst for the global slowdown and weakening trade growth isn’t the tariffs. However, they will contribute by further decelerating growth.

Leave A Comment