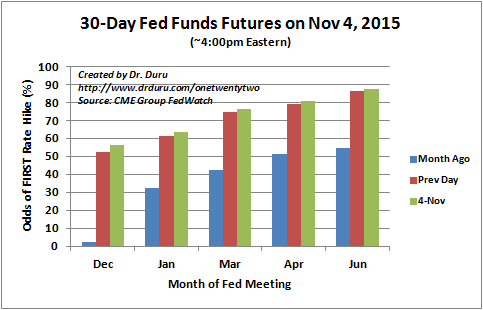

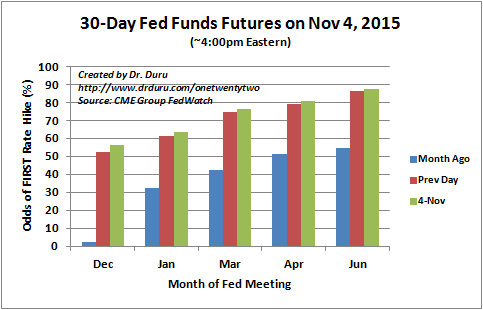

The market is once gain gearing up for a December rate hike from the U.S. Federal Reserve.

Today’s nudge came from Janet Yellen her first public commentary since last week’s decision on monetary policy. At that time, a simple and clever change in language convinced the market to pull in the month for a first rate hike from March/April to January/March. The momentum toward a December rate hike has continued, so I am sure Yellen as eager to firm up the trend. Yellen used an appearance at the House of Representatives’s Committee on Financial Services to testify on “Supervision and Regulation to encourage markets to believe in an imminent rate hike. I believe during Q&A, she made the comments that caught the headlines and further firmed up expectations for a December rate hike. From Reuters (includes video):

“‘What the committee has been expecting is that the economy will continue to grow at a pace that is sufficient to generate further improvements in the labor market and to return inflation to our 2 percent target over the medium term,’ Yellen said at a House Financial Services Committee hearing.

‘If the incoming information supports that expectation then our statement indicates that December would be a live possibility.’”

The words worked their magic on expectations. The odds for a December rate hike went from 52.3% to 56.2%. The renewed momentum toward a December hike represents a dramatic change of affairs from just a month ago .

A rate hike by January looks a lot more likely. December is now firmly back in play.

Source: CME Group FedWatch

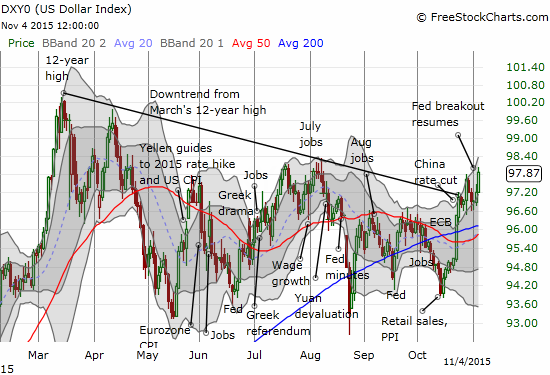

The heightened alert for an imminent rate hike is nudging the U.S. dollar index closer to a confirmed breakout.

The U.S. dollar index resumes its big breakout

Source: FreeStockCharts.com

Leave A Comment