Written by Drew Voros

One of the big changes that exchange-traded funds have brought to investors is the ability to invest in a particular technology, rather than trying to pick a singular tech company, which we know can be a loser’s game.

…The ability to invest in the potential of a robotic revolution is offered in one of the sleeper ETF hits of the year.

- has received $263 million in new assets this year, bringing its total AUM to $402 million

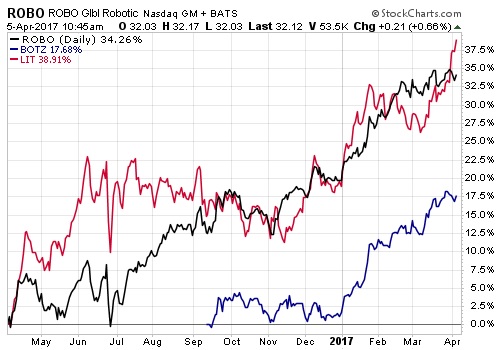

- and the 3 ½-year-old fund is up 11.8% for the year, to boot, and up 34% over the past 12 months…

- has attracted $50 million in assets since it was launched last September

- has a cheaper expense ratio, 0.68%, compared with ROBO’s 0.95%,

- and is up 15.5% for the year and has gained 17.65%since inception.

- is nearly seven years old,

- has seen $30 million in new assets this year, a 24% increase, taking its total to $162 million

- and has outperforming the crowd with a 15.3% gain year-to-date, and a 34% return in the past 12 months.

The importance of robotics and battery technology in our 21st century lives is undeniable, which certainly has been behind the attraction of these funds. There is real growth potential for these industries, and they are not difficult businesses to understand. The head-scratcher is that there are no competing funds with these two niche plays but the lack of copycats may also have something to do with how difficult it is to attract the assets ROBO has seen this banner year after launching 3 ½ years ago and, after seven years, LIT has just crossed over $160 million in assets.

- debuted in November 2014,

- has nearly $1 billion in AUM…

- and is up 11.65% this year, and 24.55% over the last 12 months.

Leave A Comment