As we like to say at Tematica, the stock market is much more like a good movie than a photo in that there are several story beats with a developing plot that can have a few twists and turns.

In keeping with our Connected Society and Content is King investing themes, we would say the market is resembling Netflix’s Stranger Things and its sequel – even though the market has been moving higher, there are things underfoot that could cause some scares and shouts like we saw last week when the market had its worst performance since August. With tax reform stalling and likely pushed out well into 2018, we’re scratching our heads to find the catalyst that will drive the market even higher from current levels.

As Tematica’s Chief Macro Strategist, Lenore Hawkins, talked about on last week’s podcast and described in Friday’s Weekly Wrap, with corporate debt levels at record highs and margin debt growing at a 12% annual rate while equity fund cash balances are at near record lows – who’s left to keep buying?

That’s the question we ponder as we look to match up earnings expectations vs. the market’s valuation, which even after last week’s modest move lower, still sits at a lofty 19.7X for the S&P 500. With the bloom off tax reform, the market will take its cue from the next rash of economic data and corporate earnings as well as company commentary to be had at investment conferences

On the Economic Front

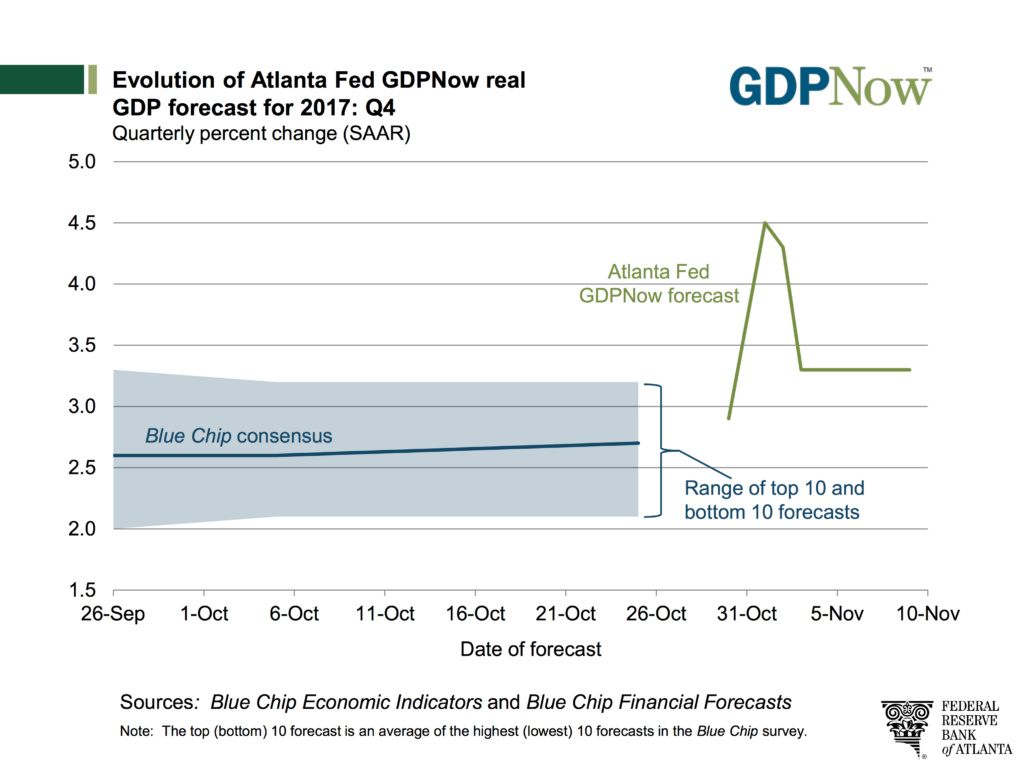

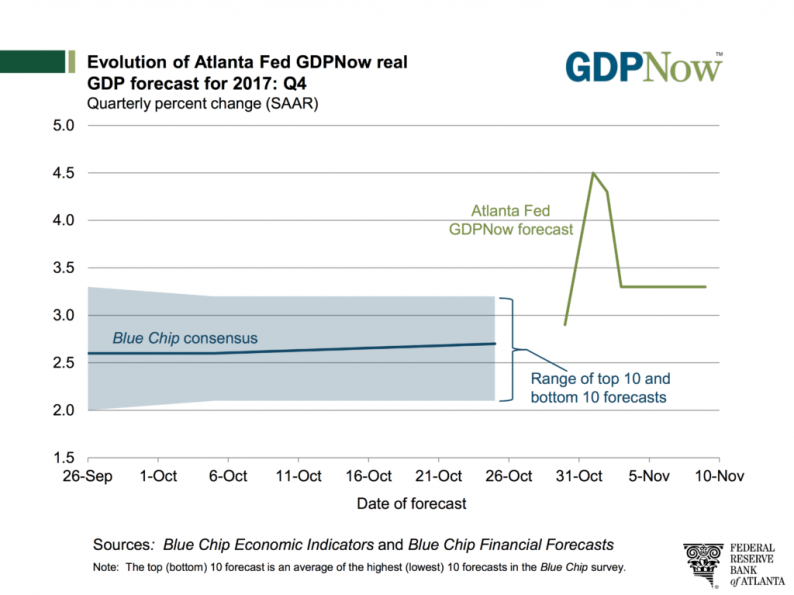

Exiting this week, we will be halfway through the current quarter (crazy we know), and that means it’s time to check in and see how GDP expectations are faring. Per the Atlanta Fed, it’s GDP Now forecast has already fallen to 3.3% from the 4.5% forecast it issued on November 1st. By comparison, the NY Fed’ Nowcast reading for the quarter is 3.16%.

Here’s the thing, we’re just starting to get the data that will shape the GDP reading for the current quarter and that means the forecasts will continue to bob and weave based on the October data. Following a relatively quiet week of economic data, the coming week will be chock full of data ranging from inflation with both the October PPI and CPI readings as well as October Industrial Production and October Retail Sales. In the Industrial Production report, we expect a positive sequential comparison as the September hurricane impact fades.

Leave A Comment