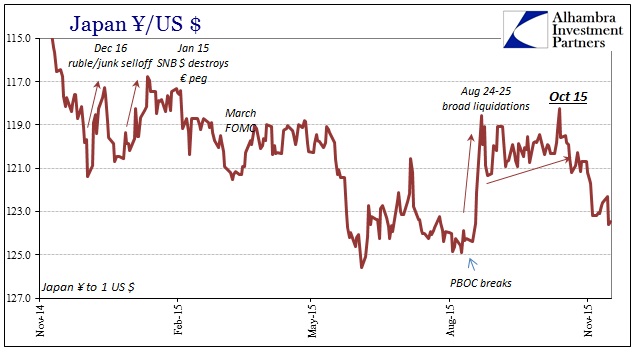

Since October 15, gold, yen and Swiss francs have all been pummeled by what increasingly looks like a “dollar” repeat from the start of Q3. It is difficult to suggest whether there is any shift in safe haven bid in all three, but I would guess, as with Q3, it may not have mattered as the “dollar” function globally has taken over marginal settings. The timing of that synchronized shift is an unambiguous financial clue, but I think it is the franc ultimately that identifies and defines, quite clearly, the “dollar.”

The downdraft in gold has been quite severe, knocking more than $110 off the price, but by relative comparison the franc displays the most nefarious comparisons. The franc has been completely hammered this morning, trading as low as 1.02 to the dollar, which would actually represent a worse exchange rate than what hit Switzerland in the days just before January 15. In reading that in wholesale terms, as China, funding costs for Swiss banks are spiking through the roof.

If this were some relatively minor, out-of-the-way financial connection to the euro/dollar world it would still be significant and troubling. But Switzerland remains a serious “dollar” hub, not only transiting between currencies but also in terms of balance sheet resource supply. When the SNB broke the euro peg back in January, the mainstream view was that the Swiss could not afford any more ECB mania intruding in the form of euro “flows.” Convention held, and remains, that the swelling of the SNB’s balance sheet by response to the euro, trying to mitigate the ECB’s internal dissention, was the ultimate trigger. Thus, if this was the case, breaking the euro peg should have arrested, or at least greatly slowed, the SNB’s recently rapid extension.

The SNB, for its part, coyly denied that was the case and was quite open that their view was a dollar one. Since that doesn’t compute in orthodox understanding, the SNB narrative remains squarely in the euro box despite everything you see above. With the passage of time, though, we can see yet again how the accepted view has been completely wrong, and, more importantly, why that matters.

Leave A Comment