Is an energy rebound on the near horizon?

I wish I could answer that, but no one can. All we can say for sure is the price of oil is far closer to a bottom than a top.

If one assumes oil is bottoming, the energy sector is an obvious play. But there are other off-sector plays worth considering.

Bloomberg noted an interesting off-sector bet on rising energy prices in its report:World’s Biggest Miner May Be About to Toast Its Oil Drillers.

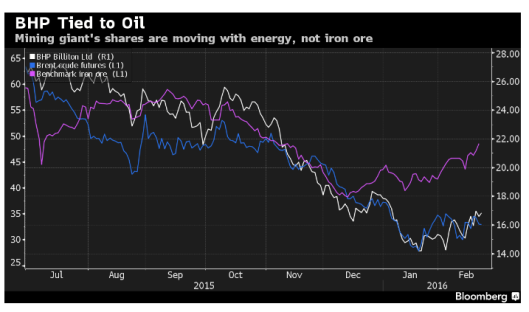

BHP Billiton Ltd.’s shares began tracking oil prices more closely last year as they headed into the worst energy market downturn in a generation. It may not seem like it, but that could be good news for the world’s biggest miner.

Unlike its rivals, BHP has a substantial petroleum unit, valued at about $25 billion by UBS Group AG. So while iron ore and most base metal prices are forecast to languish over the remainder of the decade as growth in China slows, the Melbourne-based company’s stock stands to benefit from a projected rebound in crude oil.

BHP needs an edge. Its Sydney-traded shares sunk last month to the lowest since 2005 and it’s forecast to report a 86 percent drop in first-half earnings on Tuesday. On top of that, the producer’s ultimate liability for the deadly Samarco dam burst in Brazil late last year remains uncertain and it’s been warned by Standard & Poor’s that it may face a second credit rating downgrade this year.

BHP “follows oil a lot more closely than iron ore these days,” Michelle Lopez, a Sydney-based investment manager at Aberdeen, which holds BHP shares among the $428 billion of assets it manages globally, said by phone. “When you look at the forward curve, iron ore still looks like it’s going to be at these levels if not a bit lower, whereas there are expectations of a correction in the oil price.”

Oil accounted for 32 percent of BHP’s underlying profit in fiscal 2015, compared with 39 percent from iron ore and 24 percent from base metals, according to data compiled by Bloomberg. Every $1 dollar per barrel change in crude oil impacts BHP’s net profit after tax by $52 million, according to an August filing. Melbourne-based BHP declined to comment Monday on the potential boost it may receive from an oil rebound.

Leave A Comment