If you think President Trump is upset with Federal Reserve Chairman Jay Powell, you should see what’s going on in India. Central bankers had been every government’s close friend for years; a decade even. The relationships were beyond chummy, particularly as many governments celebrated their central bank heroes for heroically heroic actions saving the world from something like a repeat of 1929.

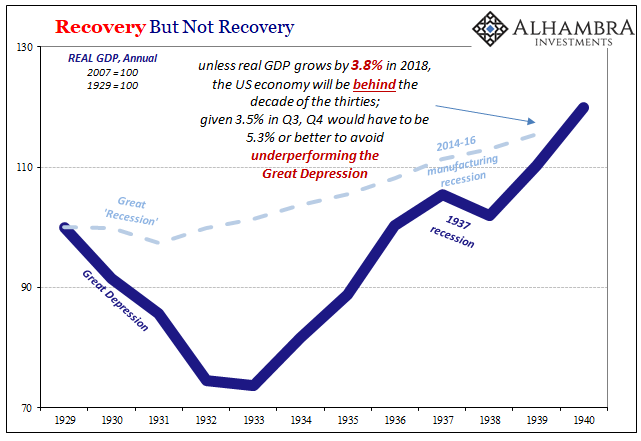

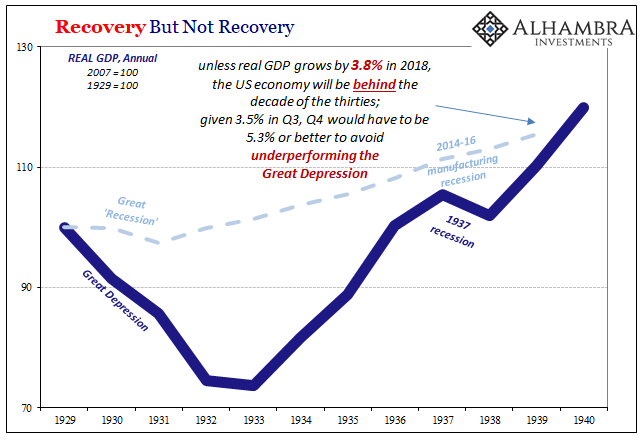

While conventional perceptions were shaped by things like QE and low rates, reality, of course, has been much different. Former Treasury Secretary Henry Paulson recently said people like Ben Bernanke saved us all from that other disastrous fate. Except the US economy is about to complete an entire decade where it has underperformed the Great Depression.

It’s the one headline you won’t see anywhere, especially not on a perfect Payroll Friday.

What that has meant for more than the US economy is often massive distance between broad categorized perception and experience. Central bankers say one thing and most of the time people believe them even if it doesn’t seem consistence with their own experience; even former President Obama is desperate to claim credit for this economic boom current President Trump is constantly talking about.

And yet, Trump is acting up about Jay Powell. It doesn’t follow unless you realize the danger of a boom that never boomed.

It’s that way in India, too, only things have already descended to the extreme. The Reserve Bank of India (RBI), that country’s central bank, has been operating a relatively constant monetary policy. Up until recently, however, that caused no disturbance nor disagreement. In other words, something has really changed.

India’s Finance Ministry has threatened just this week to invoke banking law if RBI doesn’t give in to demands from the Modi government. Unlike Western central banks, India’s is independent only by tradition. In the statute, the RBI operates at the pleasure of the government. Section 7 of the central bank act hands authorities broad powers should central bankers act outside of established policy agreements.

Leave A Comment