*Sad Trombone*

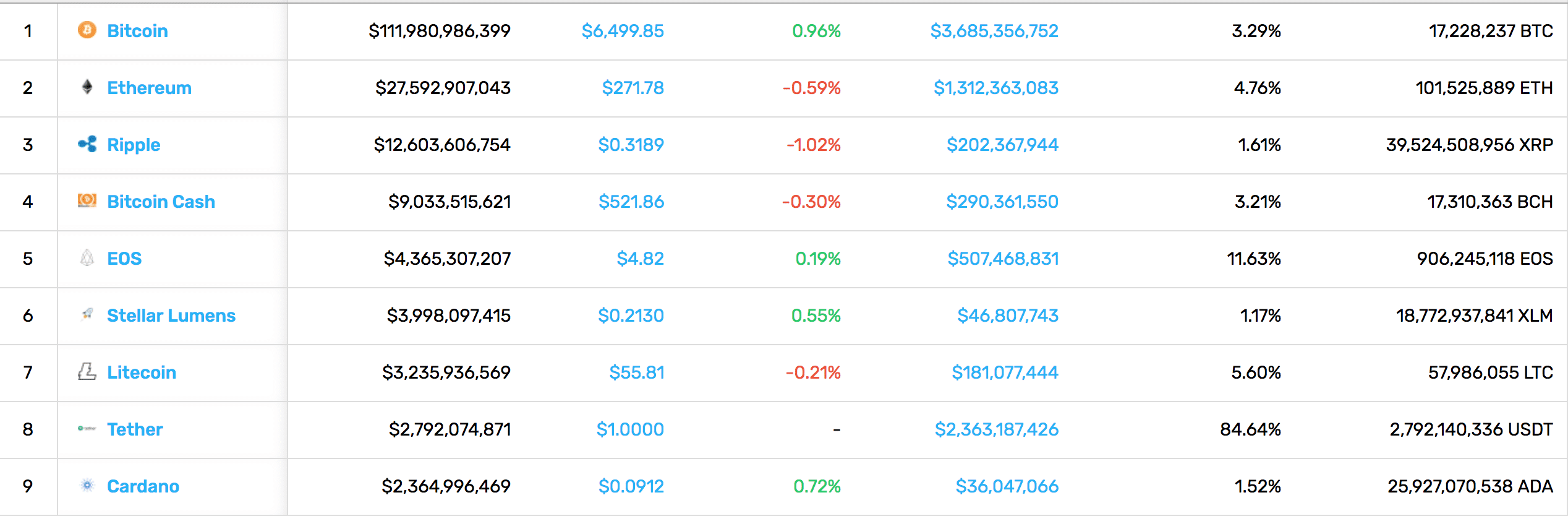

Although not a dramatic drop-off like we’ve seen in previous weeks, the market remained relatively stagnant seeing slightly lower ‘lows’ throughout the week.

This week, the entire market dipped just -0.04% on the heels of several Bitcoin ETF rejections (or were they reviews?) by the SEC. While some view anything but twenty percent gains as a negative, the lack of price movement after this negative news mean that we may have finally found a floor. Fingers crossed

Blockchain’s poster boy, Bitcoin, rose 1.29% this week – an impressive stat considering the negative press.

Ethereum continued to get hammered, down 7.35% in the last seven days.

And XRP, the coin everyone loves to hate is this week’s big winner, up 4.04%.

Domestic News

SEC Rejects Numerous Bitcoin ETFs (For Now): Eight more Bitcoin ETF proposals join the Winklevoss ETF in the SEC’s reject pile. The primary reason for the rejections, so far, has been the inability of the exchanges to provide enough proof that they can prevent market manipulation and fraudulent activity. Not all is lost, however. The SEC stated that their decision has no bearing on their opinion of Bitcoin and blockchain as a useful technology. And, investors seem to agree. Bitcoin’s price remained relatively stable even with the unfortunate news.

BREAKING: In a quick turnaround, the SEC now says that they will review the nine ETFs that they had previously rejected. These reviews could still lead to the same result, but they do bring a glimmer of hope for Bitcoin ETF hopefuls this week.

Steve Wozniak Announces Blockchain Involvement: At the recent ChainXchange conference in Las Vegas, Apple co-founder Steve Wozniak announced his involvement with a new blockchain company, Equi. This project is Wozniak’s first venture into the cryptocurrency space. Remaining relatively secretive, the Equi website only states that the project will “disrupt Venture Capital, Real Estate, and Luxury Asset Investing.” The platform is scheduled to launch in winter of this year.

Leave A Comment