We Get Knocked Down but We Get up Again

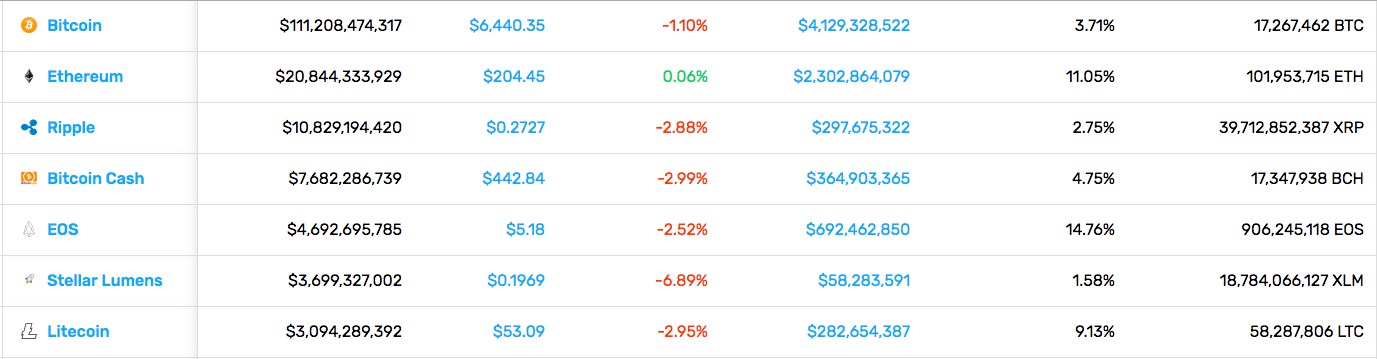

You’re never gonna keep us down. After a disappointing start to the week, the crypto market started to show some recovery leading into the weekend. The total market cap slipped from a $204B start to a low of about $186B on Wednesday before steadily climbing to end the week at just under $200B – a 2% drop.

In typical market prediction fashion, some experts are calling, “bottom” while other believe we still have further to go. With wave after wave of positive blockchain news, it’s hard to believe this isn’t the floor. Knock on wood

Bitcoin is one of the few top coins with a positive week, finishing up 0.21%.

Ethereum is still getting no love, seeing a 6.47% fall over the week.

The same can be said for XRP as it also dropped significantly, tumbling 6.32%.

Gemini Launches Stablecoin: The Winklevi are at it again. On Monday, the dynamic duo launched the creatively-named Gemini dollar, “the world’s first regulated stablecoin.” The stablecoin (GUSD) is an ERC20 token pegged 1:1 to the U.S. dollar with oversight from the New York State Department of Financial Service. Like Tether, an independent accounting firm will confirm each that the USD reserves equal the amount of GUSD. Unlike Tether, the accounting firm probably exists.

NEWS FLASH: Students Love Blockchain: It’s official, Millenials (or is it Generation Z, now?) are on board the blockchain train. Even with the downturn in the market, collegiate blockchain courses are popular as ever. Blockchain student organizations at Penn, Berkely, and, Cornell all boast 100+ strong memberships, and blockchain courses are in high demand. This continued interest even in the bearest of markets is a strong sign of the adoption to come.

Crypto Big Boys Form Blockchain Association: Coinbase, Protocol Labs, and Circle have teamed up with investors such as Polychain Capital to form the Blockchain Association. The trade association will act as a liaison to policymakers on capital hill, working to ensure crypto-friendly policies moving forward. This looks to be a positive step in removing the haze from the current blockchain regulatory landscape while (hopefully) not stifling innovation.

Leave A Comment