Exiting Losing Trades

Losing trades, to a professional trader, is nothing more than the cost of doing business. Market pros exit their losing trades without emotion, completely focused on following their trading system, money management, and risk control rules.

And as important as having winning trades is, exiting losing trades at the exact time your system advises is perhaps even more important. Losing trades tend to go from bad to worse in a hurry, and it’s your swift, passionless ability to cut such negative performers that will prevent serious damage to your trading account equity.

Here’s a look at three powerful strategies for exiting your losing trades. Generally, these style of trade exits will help keep losses small and stress levels low, preserving your trading capital for the next prime trade opportunity.

Strategy #1: Exiting After a Close Beyond a Significant Trendline

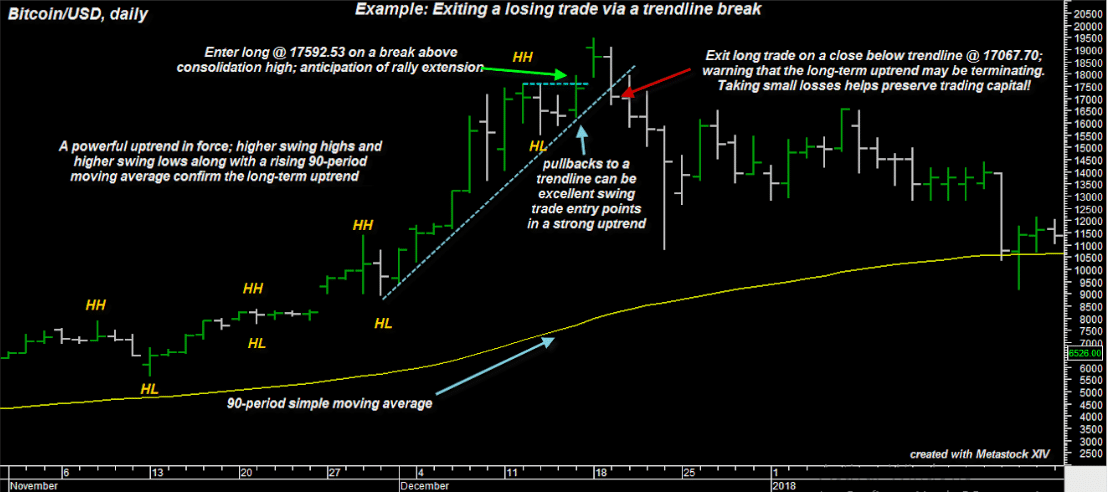

The incredible October-December 2017 rally in Bitcoin offered several low-risk long breakout and pullback entry points for chart-savvy traders. The chart below depicts the final chance to get long before the ultimate ‘blow off’ top on December 18, 2018:

Figure 1. Bitcoin/USD, daily: Pullbacks to an established trendline can often act as a low-risk entry point. Here, however, a long entry after such a pullback is stopped out for a small loss as it closes back below the trendline.

Note the backdrop for the buy setup:

Leave A Comment