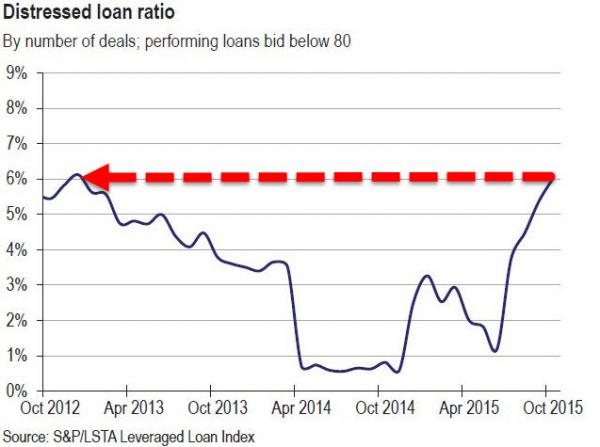

Despite distressed-debt funds suffering their worst losses since 2008, mainstream apologists continue to largely ignore the carnage in the credit market (even though veteran bond managers have urged “it’s not just energy, it’s everything.”) With the number of loan deals pricing below 80 (distressed) at cycle peaks, and “a less diverse group of investors holding a lot more bonds,” price swings continue to be wild but as DB’s Melentyev warns, initially “all of this looks random when there is no underlying news to support the big moves. But eventually a narrative emerges — maybe we have turned the corner on the credit cycle.”

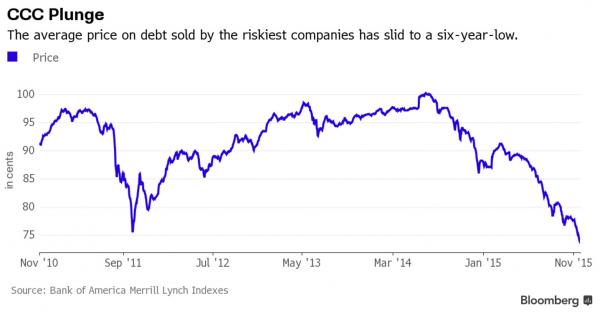

Investors are shunning the lowest-rated junk bonds.

That is underscored by the extra yield that investors are demanding to hold CCC rated credits relative to those rated BB. This has jumped to the most in six years.

As Bloomberg reports,

With confidence slipping in the strength of the global economy, there are fewer investors to take the opposite side of a trade in the riskiest parts of the market, according to Oleg Melentyev, the head of U.S. credit strategy at Deutsche Bank.

“These are all small dominoes in one corner of the market,” Melentyev said. “In the early stage, all of this looks random when there is no underlying news to support the big moves. But eventually a narrative emerges — maybe we have turned the corner on the credit cycle.

One sometimes-overlooked element that’s contributing to the big price swings is the increasing concentration among investors, according to Stephen Antczak, head of credit strategy at Citigroup Inc.

Mutual funds, insurance companies and foreign investors make up 68 percent of corporate bondholders compared with 52 percent at the end of 2007.

That means that if one mutual fund investor wants to sell some holdings, there isn’t another one that’s ready to step in. That’s because they typically have similar mandates from investors and often need to sell for the same reasons.

“A less diverse group of investors hold a lot more bonds,” Antczak said. “The difference between incremental buyers is more now than it used to be. It takes a bigger move to get people interested.”

Leave A Comment