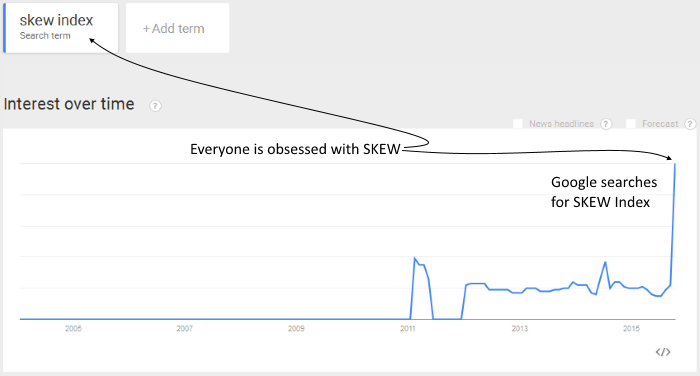

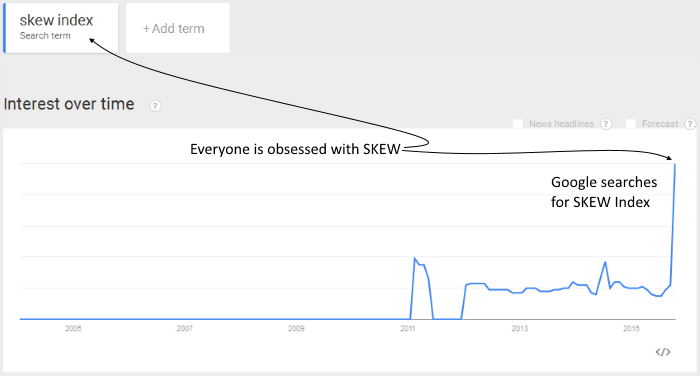

On August first I warned that the meme of poor breadth would likely cause a “substantial disruption in the markets“. This week a new meme is emerging that the all time highs in the CBOE SKEW Index indicates everyone is afraid of a black swan event and thus the market is due to crash. There has been a spike in searches on Google for “skew index” confirming the frenzy.

So, is the market going to fall due to an all time high in SKEW? I’m sorry, but I just don’t buy it. Why? Because the SKEW data doesn’t correspond to market tops. Take a look at the chart below and you’ll notice that SKEW doesn’t have a good track record of predicting declines. It has a plethora of false signals and just a few correct signals. What do you think would have happened to your portfolio if you had gone to cash or added a hedge every time SKEW spiked above 135? Side note: I pulled 135 as a signal line out of my fanny…because I couldn’t see any number in the historical data that would have provided a good signal to warn of a declining market. If you can find one please let me know. Until then please ignore the current ado about SKEW…and watch other indicators that have a good track record of predicting market declines.

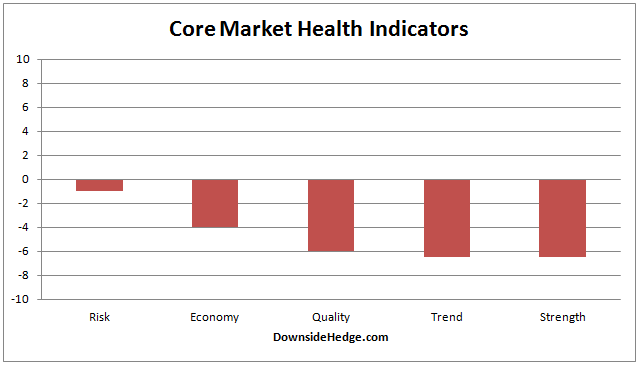

Not much has changed with my core market health indicators this week. Some improved and some declined. Most significant is my core measures of risk are close to going positive. It appears that with their current trend the category as a whole should clear next week with just a slight increase in the market. This would have the core portfolios adding some exposure in anticipation of the market going on to new highs. The volatility hedged portfolio is 100% long as of last week. Here’s a link to the current allocations.

Leave A Comment