Briefly:

Intraday trade: Our Friday’s intraday trading outlook was bearish. It proved wrong because the S&P 500 index gained 0.3% following slightly higher opening of the trading session. We still can see some short-term overbought conditions. Therefore, intraday short position is favored. Stop-loss is at the level of 2,605 and potential profit target is at 2,555 (S&P 500 index).

Our intraday outlook is bearish today. Our short-term outlook is neutral, and our medium-term outlook is neutral:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

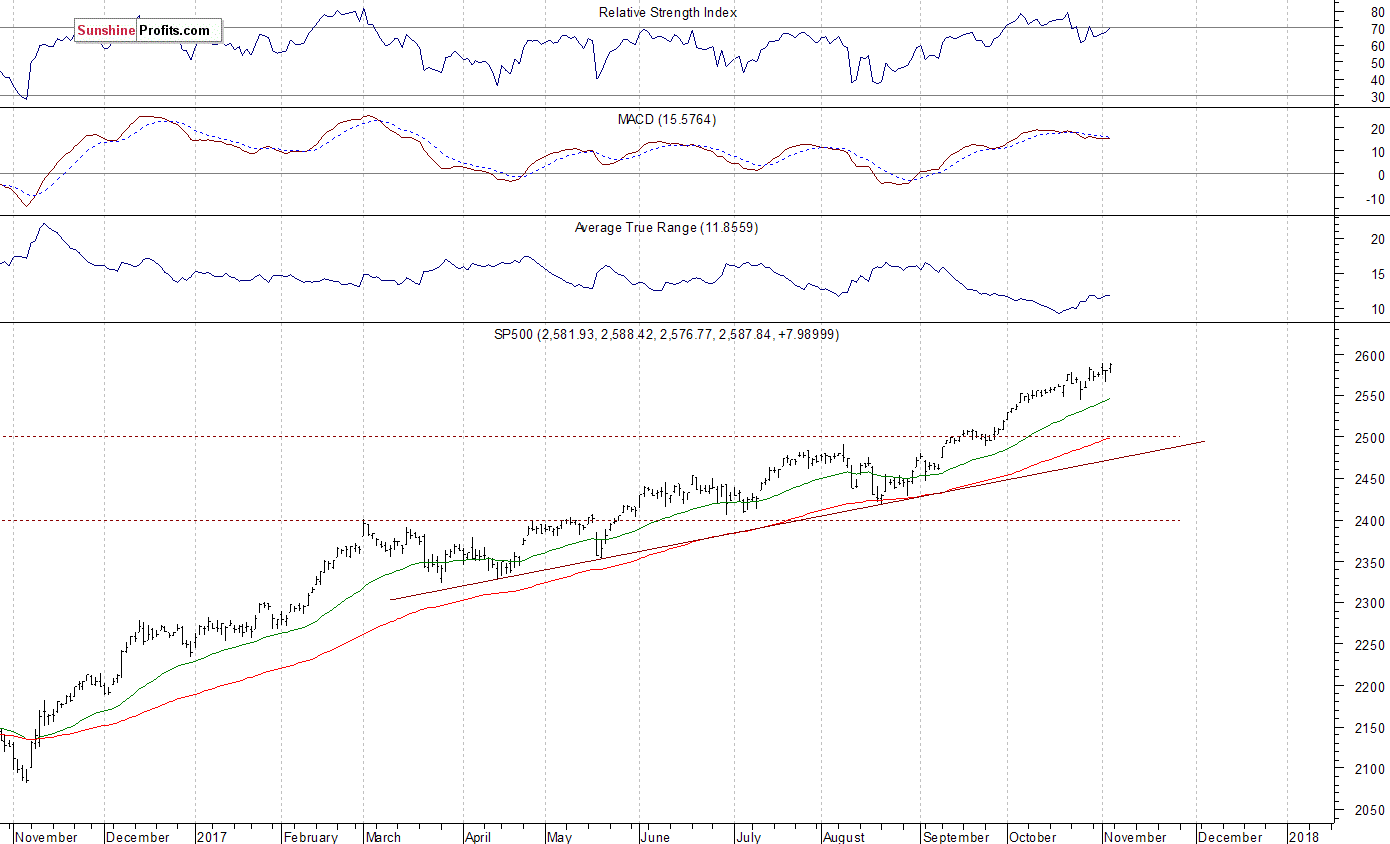

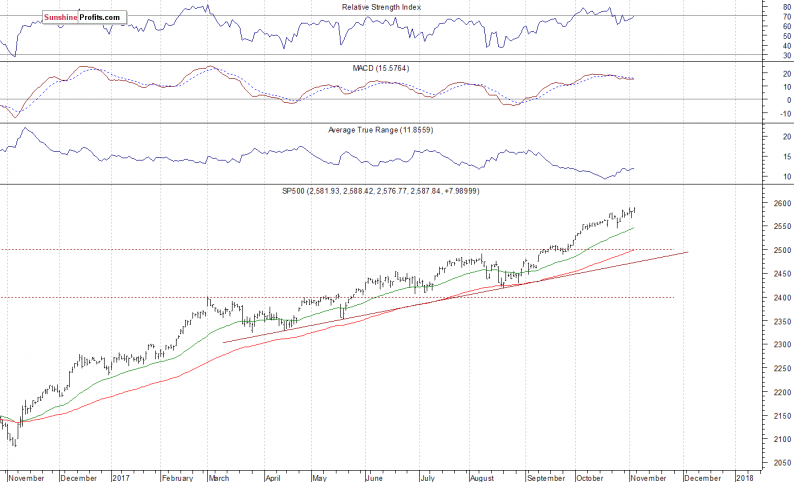

The main U.S. stock market indexes gained between 0.1% and 0.7% on Friday, as investors reacted to monthly jobs data, quarterly earnings releases. The S&P 500 index has reached new record high of 2,588.42, just 0.02 of a point above its Wednesday’s daily high. The Dow Jones Industrial Average was relatively weaker than the broad stock market again, as it gained just 0.1%. However, the blue-chip index reached new record high at the level of 23,557.06. The technology Nasdaq Composite extended its uptrend, as it reached new record high at 6,765.14, following better-than-expected quarterly earnings release from Apple. The nearest important level of support of the S&P 500 index is at around 2,575, marked by recent fluctuations. The next support level is at 2,565-2,570, marked by some previous local lows. The next support level is also at 2,560. On the other hand, potential resistance level is at around 2,590-2,600, marked by record high. The S&P 500 index extended its over eight-year-long bull market recently, as it reached new record high closer to 2,600 mark. Will bull market continue? Or is this some topping pattern ahead of downward reversal? There have been no confirmed negative signals so far. However, we still can see medium-term technical overbought conditions:

Flat Expectations

Leave A Comment