To be sure, “volatile” is a relative term these days.

But that’s how some traders are describing what we saw in equities during Yellen’s presser.

No one seems quite sure how to interpret the messaging and indeed, it’s not 100% clear that the committee did indeed deliver the “dovish” slant on the hike that many suggested would be absolutely necessary following this morning’s lackluster inflation data.

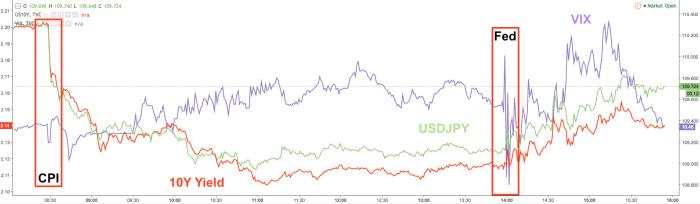

Whatever the case, the dollar recovered some of its morning losses and Treasury yields ticked higher as Yellen spoke. Stocks dipped and the VIX showed some sign of life as Yellen suggested subpar inflation prints won’t persist given the tightening labor market as the central bank continues to normalize:

Here’s some of the color from traders and analysts…

Via Bloomberg

Traders Say Stocks Caught Napping by Surprisingly Hawkish Yellen

Equity markets turned volatile during Fed chair Janet Yellen’s press conference Wednesday as traders weighed softening economic data against the central bank’s resolve to continue hiking interest rates in 2017. Here’s how some on Wall Street are reacting:

Leave A Comment