Congratulations to any of you who stuck by the iPath Bloomberg Cocoa SubTR ETN (NIB) and accumulated over the course of 2017 as cocoa prices slowly but surely carved out a bottom. Looking back, it seems September was a key turning point in the flavor of the trading.

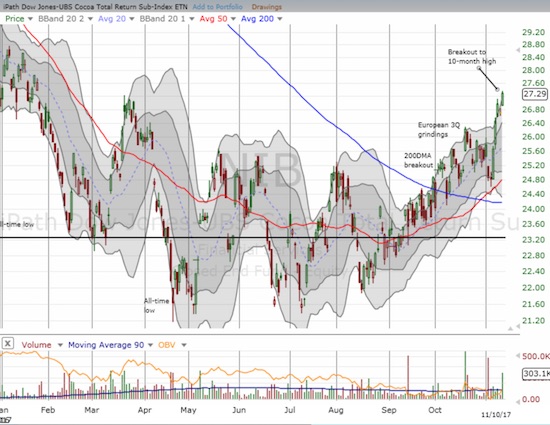

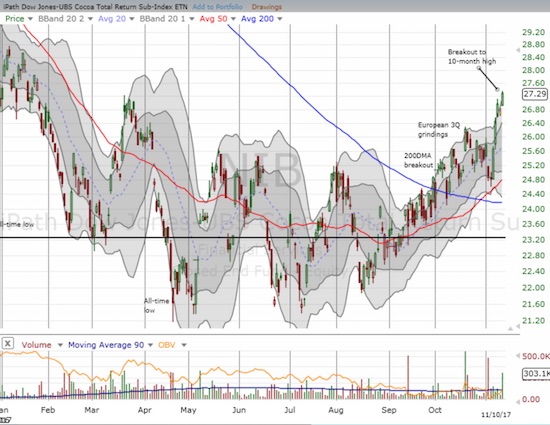

The iPath Bloomberg Cocoa SubTR ETN broke out this week to a 10-month high – an exclamation mark confirming 2017’s bottom.

Source: FreeStockCharts.com

The chart above shows how NIB made a higher low in September. The breakout above the 200-day moving average (DMA) and then the follow-through on the European third quarter grindings produced the higher highs needed to confirm the bottoming process. The monthly Cocoa Market Review for September, 2017 from the International Cocoa Organization (ICCO) also noted the change in the nature of trading in September:

“The month of September is a watershed for the calendar of the nearby cocoa futures contract. At the expiry of the September contract on 14 September, the nearby position shifts its price discovery function from the final part of the 2016/2017 mid-season to the 2017/2018 main season, i.e. December contract.”

The ICCO went on to explain that the price action from the “old crop” of the 2016/2017 season reflected the glut of cocoa supply. The price action from the “new crop” of the 2017/2018 season incorporated fears of crop damage from black pod disease brought on by wet weather conditions. The Ivory Coast, the world’s largest cocoa producer, recorded a whopping 30% year-over-year increase in the tonnes of cocoa beans arriving at the country’s ports cumulative over the previous season. However the new season launched with a 32% year-over-year drop for the first month. Commerzbank estimates crop production for the last quarter of the year could drop 13% overall year-over-year.

Meanwhile, demand looks strong for the third quarter across all regions. European grindings increased 3% year-over-year. North America nudged ever so higher by 0.7%. Asia soared 12.9% in what is an on-going show of strength as chocolate makers continue to take advantage of low prices. Based on these numbers the ICCO concluded that “…there is a recovery in the global demand for cocoa beans.”

Leave A Comment