While Donald Trump already spoiled the surprise of the contents of the latest semiannual report from the Treasury on currency manipulation, when on Wednesday he told the WSJ that China would not be named a currency manipulator, moments ago the US Treasury confirmed just that when it published the long awaited report on “Foreign Exchange Policies of Major Trading Partners of the United States” which while keeping the same six countries – China, Japan, Korea, Taiwan, Germany, and Switzerland – on its manipulation monitoring watch list, it said no major trading partner met the criteria to be designated an FX manipulator:

Pursuant to the 2015 Act, Treasury has found in this Report that no major trading partner met all three criteria for the current reporting period. Similarly, based on the analysis in this Report, Treasury also concludes that no major trading partner of the United States met the standards identified in Section 3004 of the Omnibus Trade and Competitiveness Act of 1988 (the “1988 Act”) for currency manipulation in the second half of 2016.

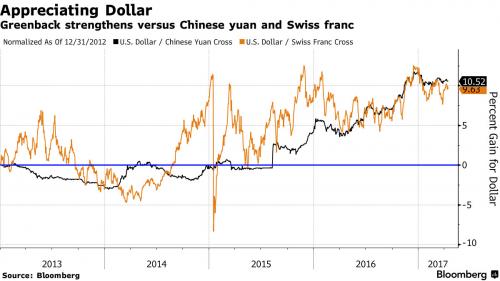

This confirms what Trump said previously, when he reverse on his campaign promise, and said China hasn’t manipulated the yuan for months, while accusing unidentified nations of devaluing their currencies and saying the dollar is getting too strong.

That said, while the US declined to label China a currency manipulator, the report appeared to toughen the language involving the world’s second-largest economy, urging Beijing to buy more American goods and services and reduce its trade imbalance, while allowing the Yuan to “rise with market forces.”

According to the report, “China currently has an extremely large and persistent bilateral trade surplus with the United States, which underscores the need for further opening of the Chinese economy to American goods and services, as well as faster reform to rebalance the Chinese economy toward greater household consumption.”

Leave A Comment