Yellen’s speaking again… give it all you’ve got!!

Stocks stalled early on (around 1010ET) thanks to inflation comments from Yellen, but that dip was bid back to the highs… then they took a little spill when Fed’s Brainard admitted “asset valuations do look a bit stretched” around 1400ET. Once again the rally-monkeys came out – even as it became clear that GOP will not have the votes for the revised healthcare bill…

Nasdaq up 5 days in a row – the longest streak since May… Early Small Caps weakness was ramped all the way back into green…

Futures show that in general markets went nowhere today…

On the week, Trannies are hovering just into the green as Nasdaq outperforms…

Retail was bid today (best day of the year), because suddenly they’re all fixed, and financials were higher ahead of tomorrow’s earnings…

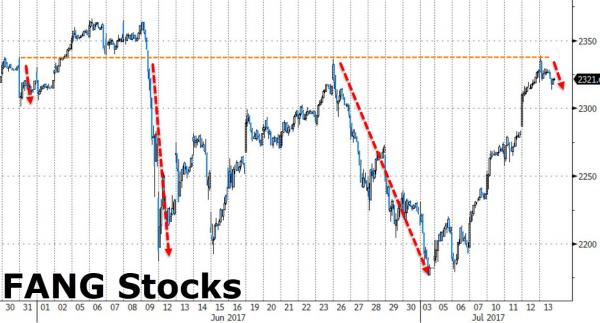

FANG Stocks spiked up to a key resistance level then faded to end the day lower…

VIX was clubbed back to a 9 handle once again every time Nasdaq dared to dip red…

Treasury yields shot higher this morning and extended their rise through Yellen’s testimony…

With 30Y spiking almost 8bps off the lows to return to unchanged for the week, before bonds rallied into the close…

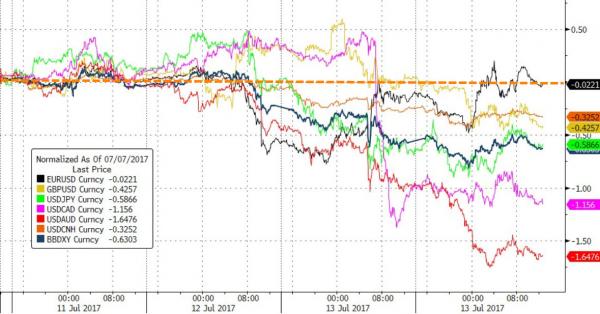

The Dollar Index slid once again (but saw quite a reversal overnight…

AUD is the best performer among the majors this week (along with the Loonie) as EUR/USD remains unch…

Despite headlines of OPEC compliance crashing to six-month lows, WTI had a sudden early bid and that ignited momentum back to pre-DOE levels, back above $46…

Gold rolled over from earlier gains as the dollar rallied this afternoon, but the precious metal closed only marginally lower…

Bitcoin leaked back lower again…

Leave A Comment