Two days after the Turkish central bank shocked the market with a whopping 625bps rate hike, which helped the Turkish lira recoup some of its YTD losses, on Monday the Turkish currency suddenly tumbled in thin trading on what some attributed was a Reuters reports that Erdogan has asked authorities to scrutinize the board of a major local bank Isbank, with the president reportedly focusing on the role the main Turkish opposition party, the Republic People’s Party (CHP) played on that board.

“It (CHP) owns 28 percent of Isbank shares. It can’t get money from there but it has four board members. What do these four members do? This must be looked into,” Erdogan told reporters while returning from a visit to Azerbaijan, local Hurriyet reported prompting concerns about a political vendetta by the “executive president” with the financial sector next.

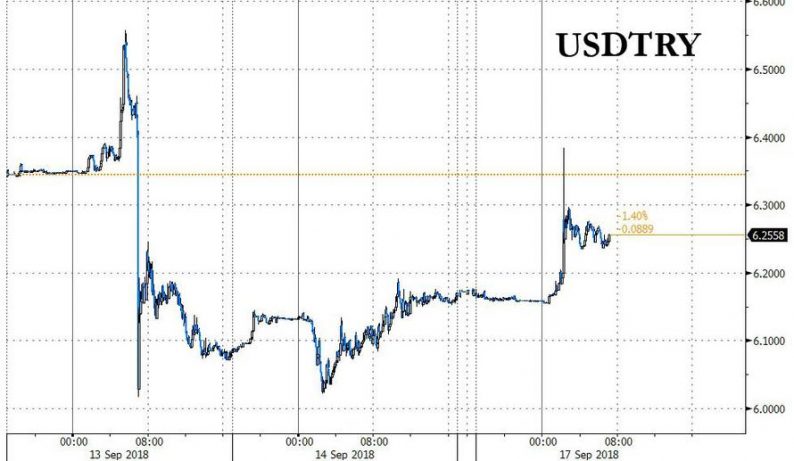

Whether this prompted the sharp spike in the USDTRY is unclear, but the currency briefly erased all gains from the rate hike before settling in the mid 6.20 range.

Separately, Bloomberg reported that in an attempt to aid Turkey’s ailing banks, the government would unveil measures to help banks tackle the expected pile-up of bad loans resulting from the lira’s plunge and soaring interest rates. Specifically, the plan will seek “to mitigate the need for capital injections and propose carving out non-performing loans” which could be transferred into a state-designated “bad bank.”

The plan will be unveiled on Thursday when Erdogan’s son-in-law and Turkey’s Treasury and Finance Minister Berat Albayrak, announces a medium-term economic program with fiscal and macroeconomic targets for the next three years.

Shares of Turkish banks rallied on the news. The plan, if confirmed, will be a welcome move for bank investors as even before the currency crisis worsened in August, Turkey’s banks – which recently dumped 20% of their gold to shore up liquidity – were struggling to deal with a pile-up of bad debt and restructurings.

Leave A Comment