What a joke this market is becoming!

As you can see from Dave Fry’s SPY chart, the S&P finished up 0.5% for the day after an amazing 10-point rally that began the second the European markets closed (11:30). It was incredible – as in NOT in the least bit credible but, as we knew, it would be enough to make Europe regret yesterday’s 2% sell-off and then Europe would bounce this morning (up over 2%)and that would then boost our Futures (now up 0.66%). This BS was so obvious that we closed our day in the Live Chat Room with this trade idea for our Members:

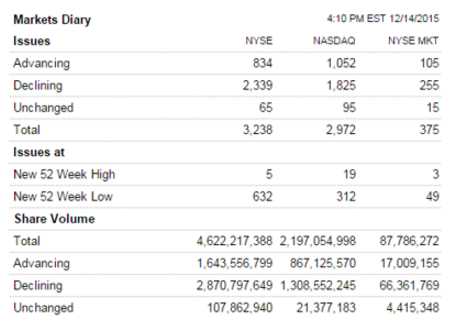

As you cans see we popped to 1,115 for an $800 per contract gain but now we’re flipping short because, as noted, yesterday’s rally was complete BS – which is obvious if you look at the internals:

This is why charts don’t give you the real story! 2,339 declines vs 834 advance with 632 new 52-week lows and we finish up 0.5%? That’s incredible – NOT credible. Still, there was the good old support line at 2,000 so of course bouncy. 2,100 to 2,000 means 2,020 is weak and 2,040 is strong but when you get an air bounce off 2,000 (never quite hit it outside of a brief spike), then minimum expectation is a strong bounce:

At the moment, the S&P Futures (ES) are at 2,023 and the weak bounce line is holding, as expected. It’s the strong bounce line (2,040) that we care about today – anything less than that is a shorting opportunity, not a rally signal. Another fun play from yesterday morning’s post (that you can read for FREE) was our suggestion to short the Nikkei Futures (NKD) at 18,800 “looking for at least a 100-point gain ($500 per contract).”

Yes, you are welcome – Merry Christmas. Of course, this is actually Hanukkah and today is the last of our 8 FREE gifts from Philstockworld. I hope you’ve enjoyed all the free trades from our December posts – we’ve certainly made enough money on these Free Trade Ideas to boost the economy into the holidays!

Leave A Comment