There’s been a significant trend change in the gold market and it has the Western Central Banks worried. Before the collapse of the U.S. Investment Banking system in 2008, annual net physical gold investment was negligible. However, the present situation has changed considerably, putting severe stress on Western Central Bank policy makers.

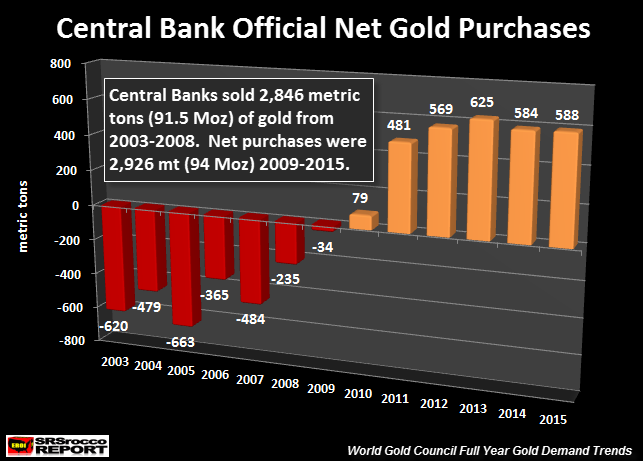

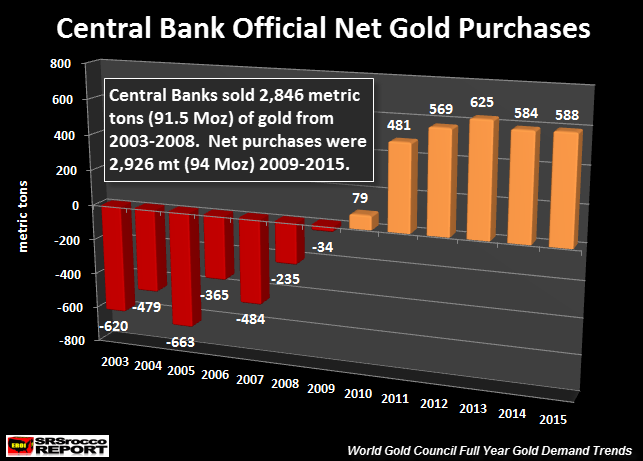

Prior to 2008, many Central Banks (mostly Western) were net sellers of gold into the market. This official Central Bank policy was designed to keep the gold price from moving up higher. According to the figures from the World Gold Council, from 2003 to 2009, net sales of Central Bank gold totaled 2,846 metric tons (mt), or 91.5 million oz (Moz):

Central Bank gold sales peaked in 2005 at 663 mt and accounted for 21% of total demand that year. What would have been the market price of gold if the Central Banks didn’t dump 91.5 Moz over the seven-year period (2003-2009)?

Then something changed in 2010. As the United States and other Western Central Banks (Japan & then the EU) continued their massive QE (Quantitative Easing – money printing) policies, Eastern and various Central Banks became net buyers of gold.

Net Central Bank gold buying started at only 79 mt in 2010, surged to 625 mt in 2011 and is estimated to be 588 mt for 2015. Again, the majority of Central Bank gold purchases were from Eastern governments, especially in 2015. Russia and China accounted for majority of Central Bank gold purchases last year.

What a trend change… aye? From 2003-2009, Central Banks dumped 91.5 Moz of gold into the market. However, this totally reversed as Central Banks were net buyers, acquiring 94 Moz of gold from 2010-2015.

Net Physical Gold Investment Has Western Central Banks Worried

While Western Central Banks dumped gold onto the market to suppress the price, Eastern Central Banks are doing the opposite. Thus, Eastern Central Bank gold purchases have put more stress on “Net Physical Gold Investment.” I say physical gold investment as I have excluded changes in Global Gold ETF inventories. While Gold ETF’s (GLD) are a gold investment vehicle, there is speculation that some (or a large percentage) of the Global Gold ETF inventories may be fictitious or oversubscribed. By the term oversubscribed… it refers to the notion that there are more than one owner for each ounce.

Leave A Comment