GBP/USD slips ahead of the Autumn statement

GBP/USD is edging lower after reaching a 2 1/2-month high earlier in the week. The US dollar sell-off has steadied following the release of the FOMC minutes, and investors are looking cautiously ahead to Chancellor Jeremy Hunt’s Autumn Statement. Some measures have been pre-released, such as a cut to National Insurance contributions for 28 million along with full expensing, a permanent tax cuts for businesses. The UK will also lift the national living wage by almost 10% next year to £11.40. Attention will also be paid to the OBR’s growth forecasts, which are expected to be downwardly revised from the March figures of 1.8% growth for 2024 and 2.5% growth for 2025. The BoE is forecasting growth closer to 0% for these periods. Inflation forecasts are also likely to be revised higher. The OBR had been expecting inflation to fall to 0.9% next year, which seems a little optimistic. With inflation still over 2.5 times the Bank of England’s 2% target, the market will be watching closely for measures that are considered to be overly inflationary and could impede the UK’s progress toward lowering inflation. With Liz’s Truss’ budget disaster still fresh in the Conservatives’ memory, unfunded and giveaway measures are unlikely. However, Jeremy Hunt could be paving the way for tax cuts in the Spring. Meanwhile, the US dollar has halted its recent slide after the minutes from the Federal Reserve’s most recent policy meeting showed that the central bank was likely to keep interest rates high for longer. Policymakers noted that inflation remained well above the target but favored keeping rates steady over lifting interest rates further. The Fed is showing that they are not ready to declare victory in their fight against inflation just yet. There was also no suggestion of rate cuts coming anytime soon. The market is pricing in a cut in Q2 next year. Looking ahead, in addition to the Autumn Statement, attention will be on US jobless claims, durable goods orders, and Michigan consumer sentiment. Any signs of weakening data could fuel bets that the Federal Reserve will cut rates in Q2 2024.

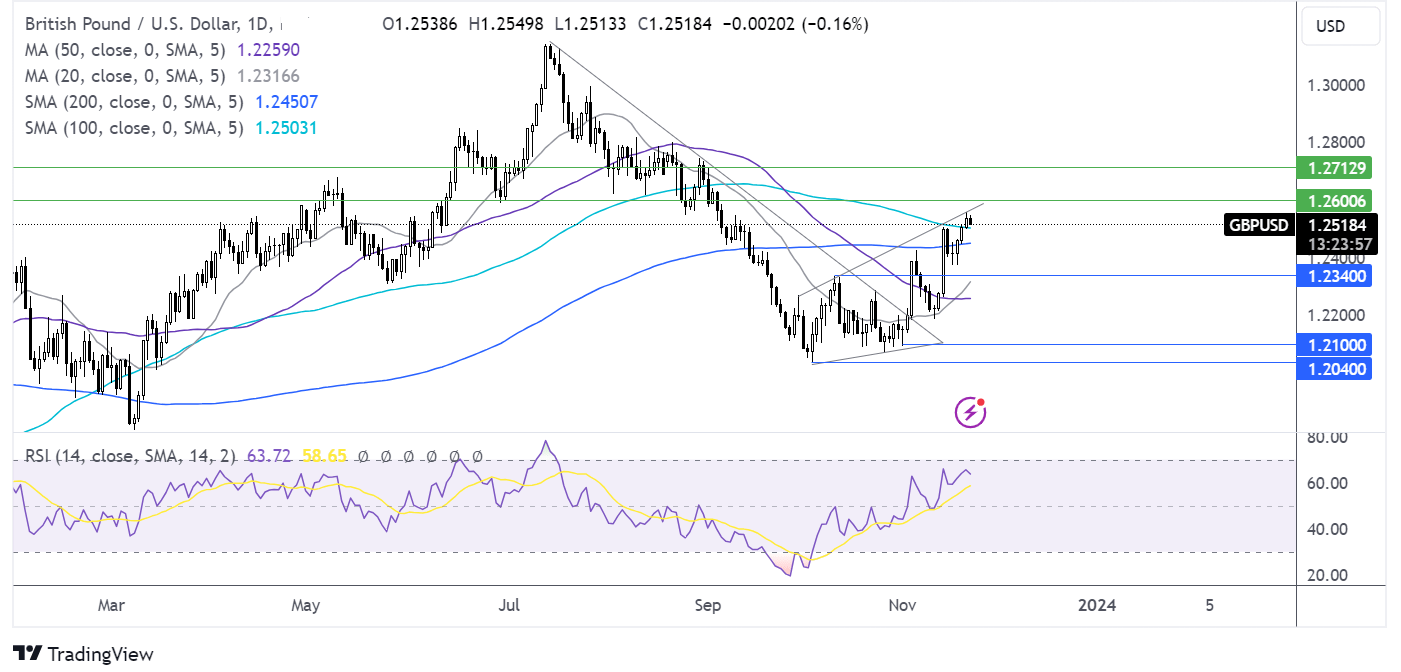

GBP/USD forecast – technical analysis GBP/USD has risen above the 200 & 100 DMA, and the RSI is above 50, keeping buyers hopeful of further gains. A rise above 1.2560 is needed to extend the bullish runup towards 1.26, the June 30 low, and on towards 1.2710, the September high. Support can be seen at 1.25 the 100 SMA ahead of 1.2440 the 200 sma. A break below here could see sellers gain momentum.

FTSE rises with the Autumn Statement due, Sage outperforms

The FTSE 100 is seen opening higher ahead of the Autumn Statement although the announcements could have a greater impact on the FTSE 250, which is more closely skewed toward domestic UK companies. That said, measures to support business investment and infrastructure projects could lift sentiment.Sage is set to outperform after the accounting firm posted strong results for the year ending 30th September. Underlying recurring revenue rose 12% to £2.09 billion owing to 25% growth at the business cloud unit, meanwhile, underlying profits grew 18%. Investors cheered the announcement of a 5% increase to the dividend and a share buyback programme of £350 million. B&Q owner Kingfisher is falling after cutting its profit guidance for a second time this year due to ongoing market weakness in France. Adjusted pre-tax profit for the year is expected now at £560 million down from £758 million the year before.

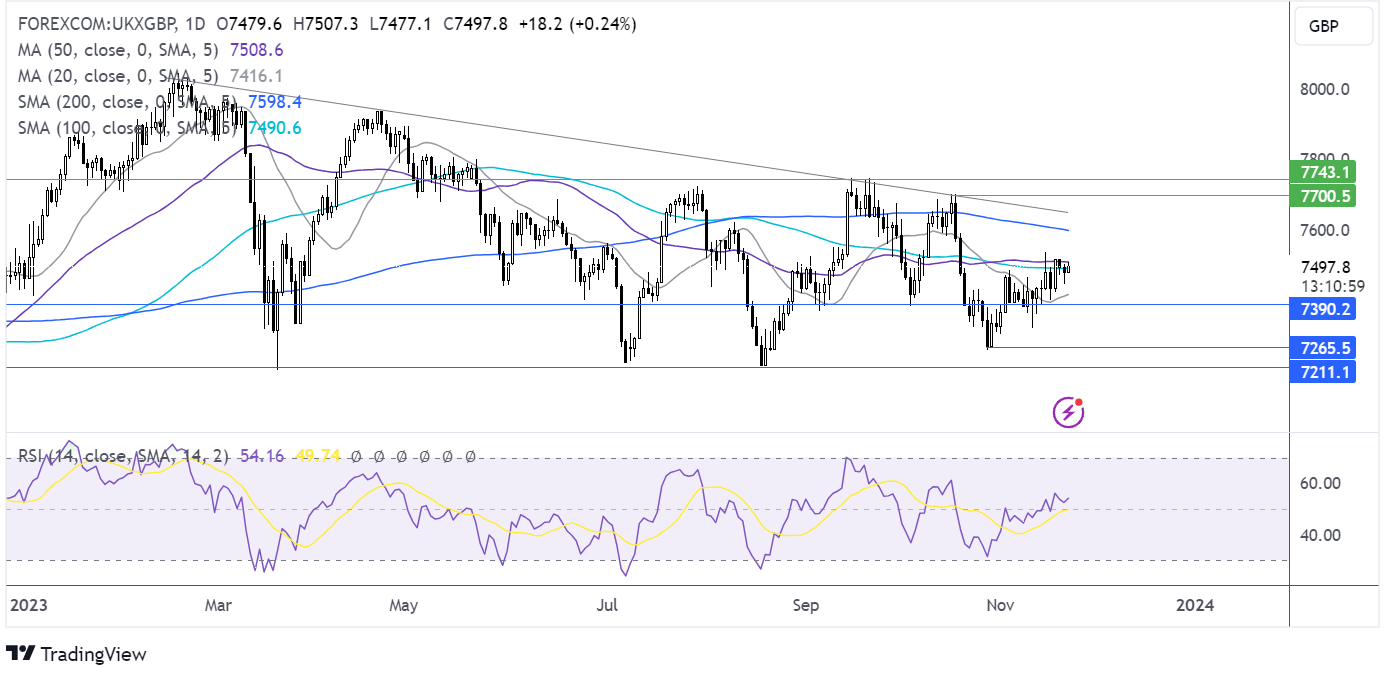

FTSE 100 forecast – technical analysis The FTSE 100 has recovered from October’s low of 7257 but has run into resistance around 7500 the round number and 50 sma. A rise above here is needed to extend gains towards the 200 sma at 7600 and the multi-month falling trendline at 7650. Failure to rise above 7500 could see sellers test 7390 at the early October low, before bringing 7260 back into focus.  More By This Author:Two Trades To Watch: GBP/USD, USD/JPY Forecast – Tuesday, Nov. 21

More By This Author:Two Trades To Watch: GBP/USD, USD/JPY Forecast – Tuesday, Nov. 21

Two Trades To Watch: GBP/USD, DAX Forecast – Monday, Nov. 20

Dow Jones Forecast: DJIA Rises Cautiously And Is Set For Strong Weekly Gains

Leave A Comment