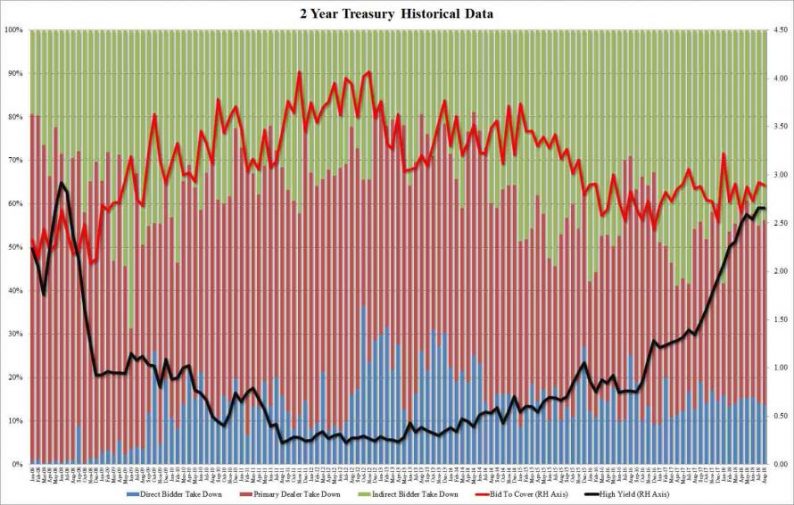

With the When Issued for today’s 2Y auction trading at 2.655%, just below last month’s 2.656%, the question of whether we would have a new 10-year high yield in the 2Y auction was on everybody’s lips. And just after 1pm we got the answer, when the “twos” priced on the screws, with a high yield of 2.655%, fractionally below last month’s 2.657%, and just shy of a new 10-year high.

The internals were mediocre, with the Bid to Cover dropping from 2.921 to 2.894, if above the 6 month average of 2.80. Directs took down 13.7%, below both the July print of 14.3 and the average of 14.6%; Indirects were left with 43.8%, below last month’s 45.0% and just above the 6-month average, leaving 42.5% to Primary Dealers, below last month’s 40.7%.

Overall a solid auction, meanwhile the 2s10s curve keeps sliding, and today was as low as 18.96bps before rising above 20bps after a selloff in the long end.

Leave A Comment