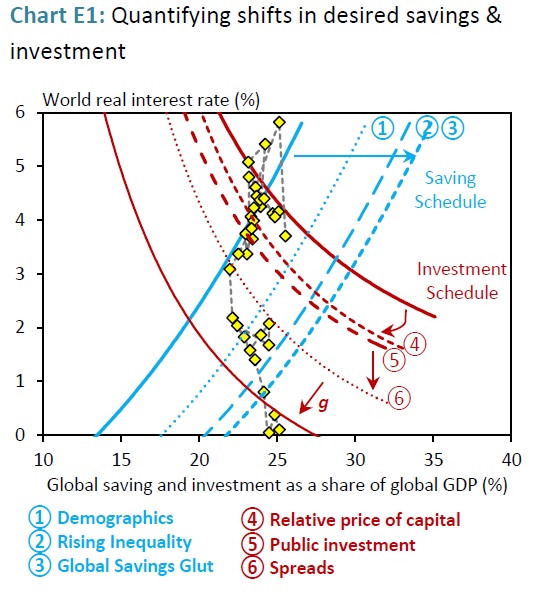

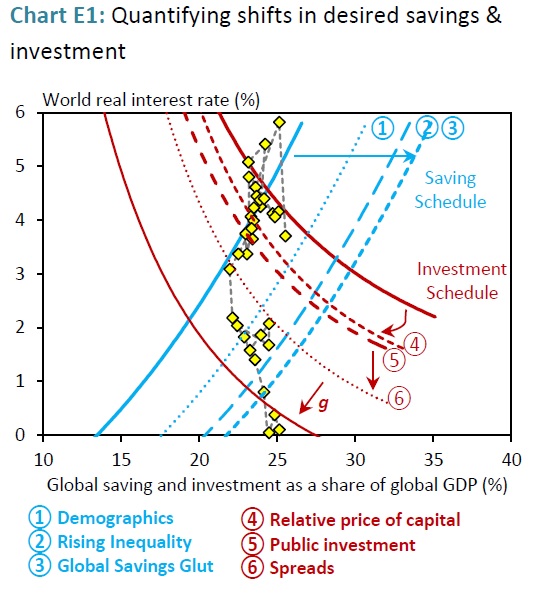

Tim Taylor at the Conversable Economist found an excellent article that explains the world-wide drop in interest rates over the last three decades. Titled, “Low for Long? Causes and Consequences of Persistently Low Interest Rates,” it contains the following supply and demand graph showing the impact of various events:

The paper offers the following general explanation:

Our analysis suggests the desired savings schedule has shifted out materially due to demographic forces (90bps of the fall in real rates), higher inequality within countries (45bps) and a preference shift towards higher saving by emerging market governments following the Asian crisis (25bps). In addition, desired investment rates appear to have fallen as a result of the decline in the relative price of capital goods (accounting for 50bps of the fall in real rates), a preference shift away from public investment projects (20bps), and an increase in the spread between the risk free rate and the return on capital (70bps)

An older population saves more for retirement while the people with higher incomes save more. Finally, Asian countries are notorious savers, a trend only exacerbated by the Asian crisis. All of these events greatly increased the supply of loanable funds, driving down supply (and lowering the cost of money). Regarding demand, we’ve seen a noticeable shift away from both public and private investment. The combination of these events has driven interest rates lower over the last 30 years.

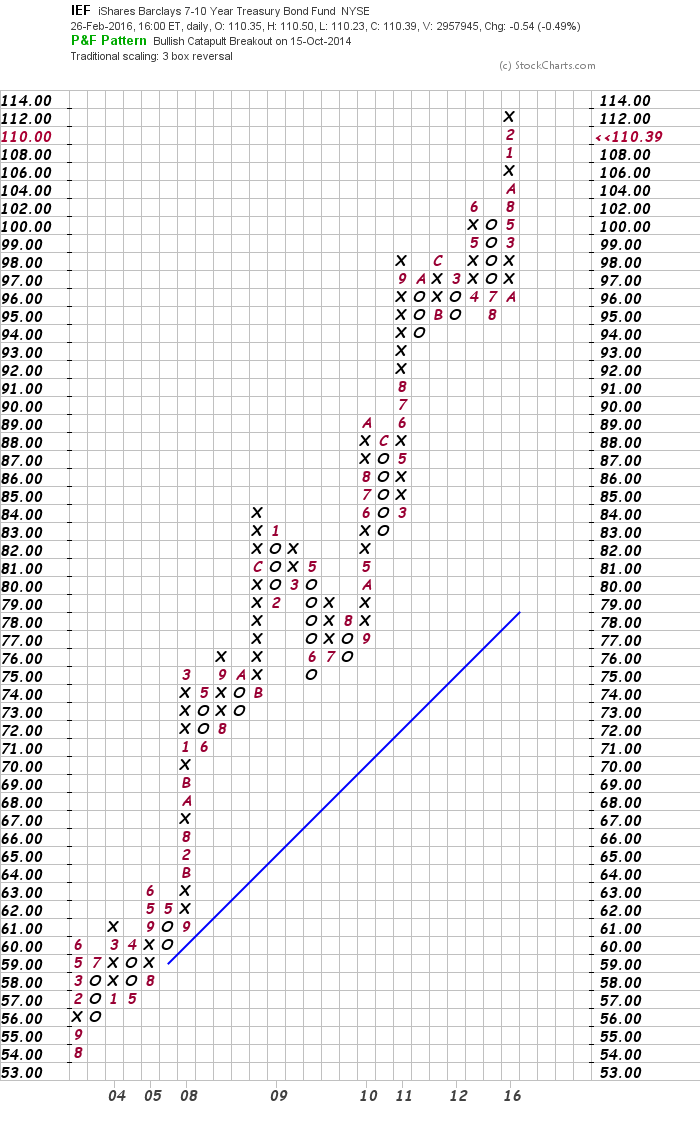

This article naturally segues into this week’s chart analysis, which shows that the bond market is still in a multi-year rally. However, the breadth of the advance is important. Let’s start with a P&F chart of the IEFs:

There are five separate strong advances on the chart: 2 in 2008 and one each in 2010, 2011 2016. Only one – the second 2008 rally – has any type of meaningful sell-off. Three are followed by a period of consolidation, allowing the markets to “take a breath” before advancing further. And the chart shows a total advance of over 100%.

Leave A Comment