Cycles Not In Tune

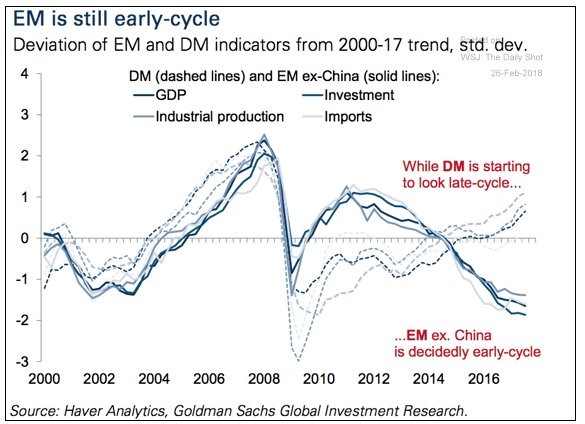

The developed markets are likely a couple years away from the end of their business cycle, while emerging markets are just recovering from their recession. India and Brazil had weak economies in 2017. They’re looking to see acceleration in 2018. The countries which export commodities are probably going to have a good next couple years because prices are increasing partially due to demand from developed markets and partially because of supply constraints. As you can see, China isn’t included in the group of emerging market economies. China had a relatively strong 2017, but will probably resume its multi-year growth deceleration in 2018. China provides demand for the commodities that most emerging markets produce. Its weakness in 2018 could limit these countries’ growth. It could also limit the cycle peak in emerging markets in the next few years. However, that’s immaterial now because they are at their trough.

Since developed markets will also be weakening, it will be interesting to see how that effects emerging markets in the next few years. In 2018, developed market demand should still be strong for commodities, so emerging markets will accelerate. Once developed markets decline, it will be interesting to see if emerging markets can still improve. Developed markets stagnated a bit when emerging markets were collapsing. While weak emerging markets hurt trade growth, developed markets were helped by cheap commodities. I’ll be watching this interplay as the two groups head in opposite directions.

It’s important to point out that this interplay between emerging and developed markets isn’t the only factor that affects growth. Low unemployment and increasing inflation mean developed markets are a couple years from the end of the cycle. American stocks are very expensive, so the risk on cycle should end soon. Monetary policy in most of the developed markets is also tightening.

Leave A Comment