The recent turbulence in global markets is a signal that the potential for macro risk is on the rise. One way to quantify the threat for the US economy is by monitoring four financial stress indexes that are published by regional Fed banks. Although all of these benchmarks show that risk has increased lately, current levels remain well below their respective danger zones. That’s no guarantee of smooth sailing, but the fact that financial stress remains in the “normal” if slightly elevated range suggests that this variety of risk isn’t a major threat for the US economy at the moment. Trouble could arise for other reasons, of course, but the odds are low that a financial-related catalyst will create a problem for the US in the near term.

The St. Louis Fed’s FRED database conveniently collects this data, which makes monitoring the risk indexes easy. Although all four metrics are attempting to quantify the degree of stress in the US financial system by tracking a range of factors, each uses a different methodology and data set and so reviewing all the benchmarks offers a relatively robust and diversified risk profile. The following is a summary of where we stand at the moment, based on numbers collected this morning (Oct. 30).

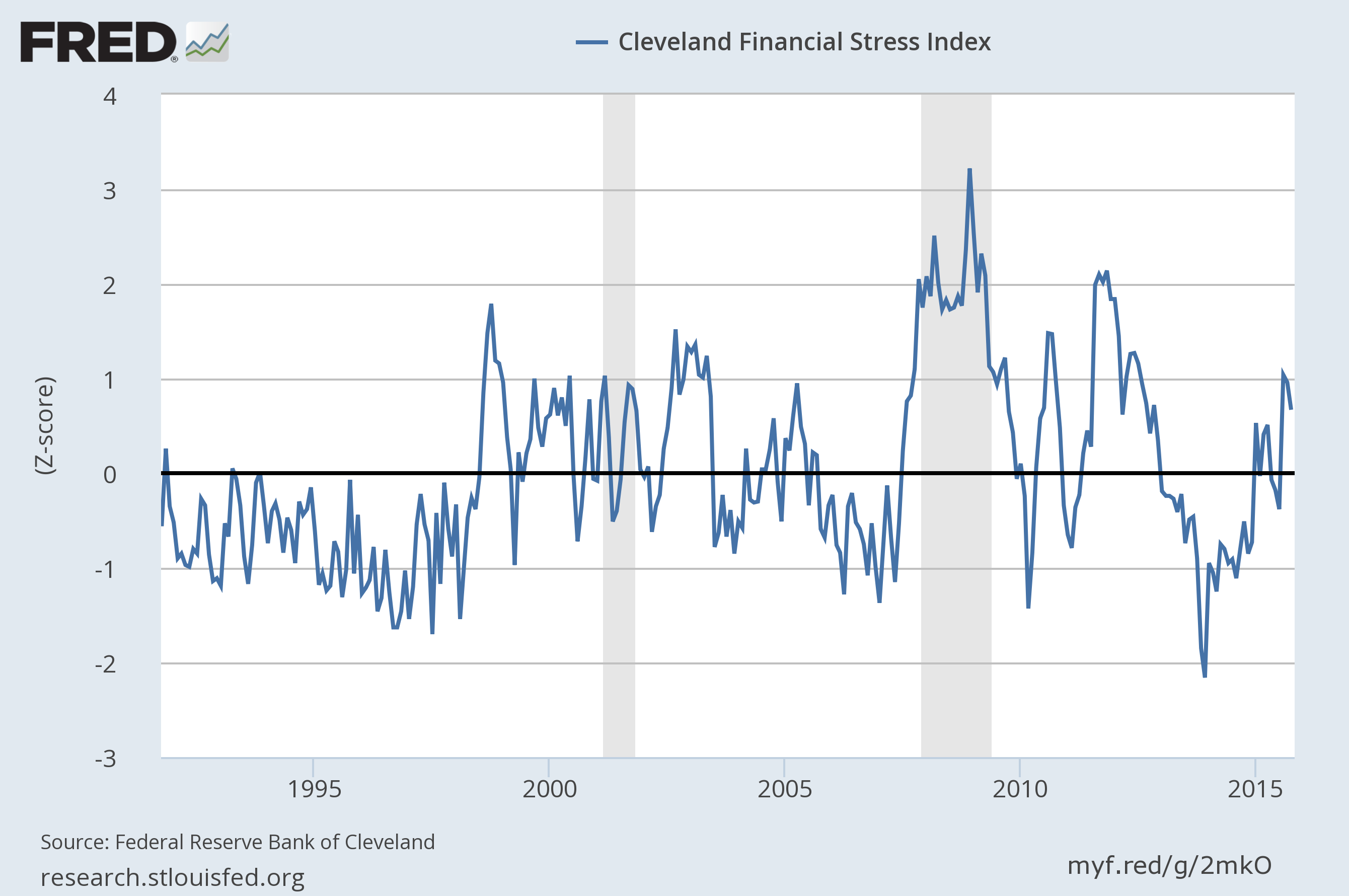

Cleveland Fed US Financial Stress Index

Published daily by the Federal Reserve Bank of Cleveland, this benchmark has recently increased to a “moderate” level of financial stress. The +0.67 reading for Oct. 28 is close to a three-year high, but only values at or above +1.82 are considered at a “significant” degree of stress.

St. Louis Fed US Financial Stress Index

This weekly measure of financial stress has been trending higher lately, reaching -0.84 for the week through Oct. 23. But that’s still considered a low level. According to the St. Louis Fed, “values below zero suggest below-average financial market stress.”

Leave A Comment