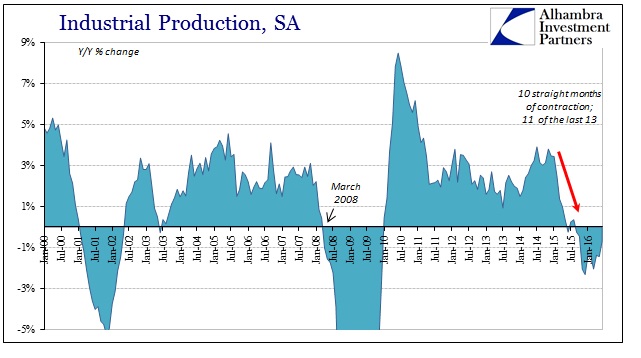

Industrial production in the United States remains caught up in the latest downward shift of the 2012 slowdown. The Federal Reserve estimates that overall industrial production contracted for the 10th straight month, falling 0.7% in June 2016. The degree of decline is relatively small, but as with so many other accounts the lingering of the condition for an only increasing period of time is highly concerning.

With another smaller contraction, it seems likely that US industry remains closer to fine-tuning production levels rather than the usual recessionary slashing. The problem with that approach is that despite an already-lengthy adjustment period the imbalance of inventory only remains. The fact that production levels are consistently declining shows, as does the increase in commercial bankruptcies noted yesterday, that the topline economic environment is unusually weak; even beyond the lack of recovery witnessed in the years before 2015.

The oil sector has for a few months weighed on overall production levels, but not disastrously so. The drag from declining activity in the mining sector is still relatively small, meaning that the struggles in domestic industry aren’t just this one factor.

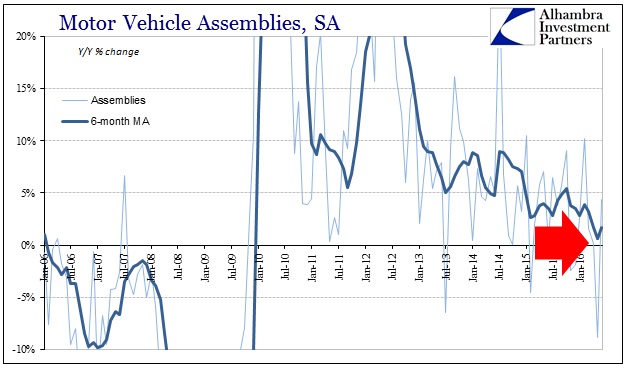

The greater contribution to industrial weakness has been from domestic auto production. Auto assemblies in May were visibly weak, nearly 9% less than May 2015, but only partially rebounded in June. Year-over-year, motor vehicle assemblies were up 4.3% and thus not close to an offset to the prior month’s slow pace. US auto production has been off-trend since last summer, becoming more serious (though not nearly like a recession) by November. Despite June’s better estimate, production in the first half of the year is only 1.5% higher than the first six months of 2015.

It shows, as overall IP, that producers are actually responding to economic weakness but in smaller, measured production changes. The buildup of inventory in especially the auto segment on the wholesale level is itself recessionary, so it raises the question about why producers aren’t making more of an effort to better align industry output with slowing sales.

Leave A Comment