Retail sales and industrial output bounced back in June, providing more evidence that recession risk remains low for the US. Although both indicators have been wobbly this year, today’s updates suggest that the trend is stabilizing after a rocky first half for 2016.

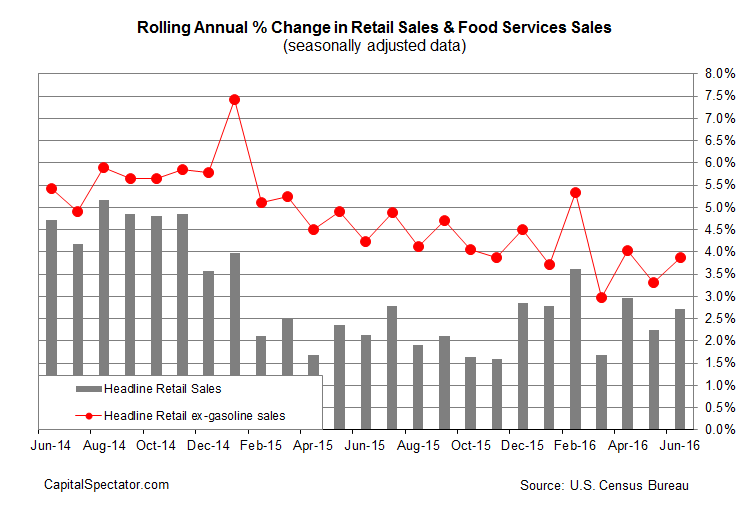

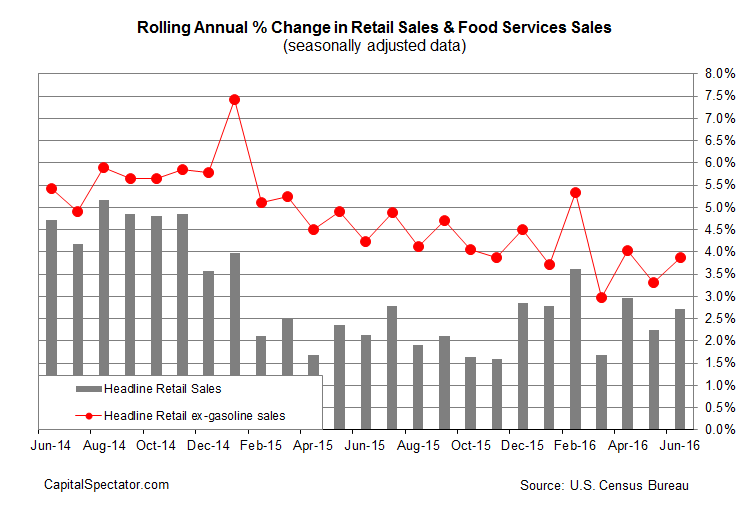

Let’s start with retail spending, which accelerated to a strong 0.6% monthly rise in June—well above May’s 0.2% increase. More importantly, the year-over-year trend is looking stronger. Headline spending ticked up to 2.7% last month vs. the year-earlier level. Although that’s a middling pace relative to recent history, the last several months suggest that the annual trend is recovering after dipping to a worrisome 1.7% annual increase in March. Stripping out gasoline sales from retail spending reflects an even stronger profile. Spending ex-gas jumped 3.9% for the year through June.

“There’s a bit more confidence about job security, there’s a bit more confidence about where things are headed in terms of wages and the economy, Omair Sharif, senior U.S. economist at Societe Generale, tells Bloomberg. “All of that is combining to give us the rebound we’re seeing in retail sales.”

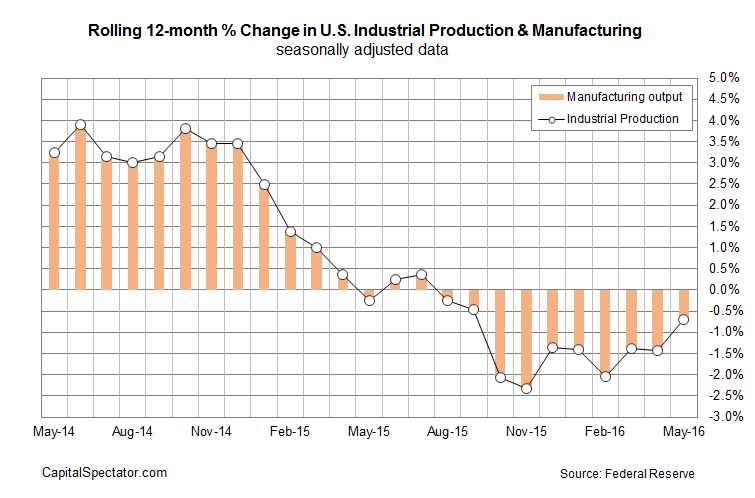

Industrial output’s June profile looks encouraging as well, at least by recent standards. Production surged 0.6% last month, a sharp U-turn from May’s 0.3% slump. The monthly advance marks the strongest gain since last October.

In annual terms, industrial activity is still sinking, but a recovery appears to be underway. Output eased 0.7% in June on a year-over-year basis. But that’s the smallest decline in eight months and roughly half the decline in May.

The near-term outlook for economic growth is still moderate, but today’s figures bolster the case for expecting that the seven-year US expansion remained intact through last month. Surprising? Not really. The Capital Spectator’s economic profile updates have consistently revealed a bias for growth throughout this year (see last month’s update, for instance). Although the forward momentum has slowed in 2016, the broad trend never reached the tipping point.

Leave A Comment