All the UK inflation numbers came out worse than expected. Headline CPI is only 3% y/y and 0.1% m/m. Core CPI is also unchanged at 2.7% instead of 2.8% predicted. The Retail Price Index (RPI) advances to 4% but also falls short of predictions. PPI data stands out by exceeding expectations at 1%, but this is a volatile, second-tier figure.

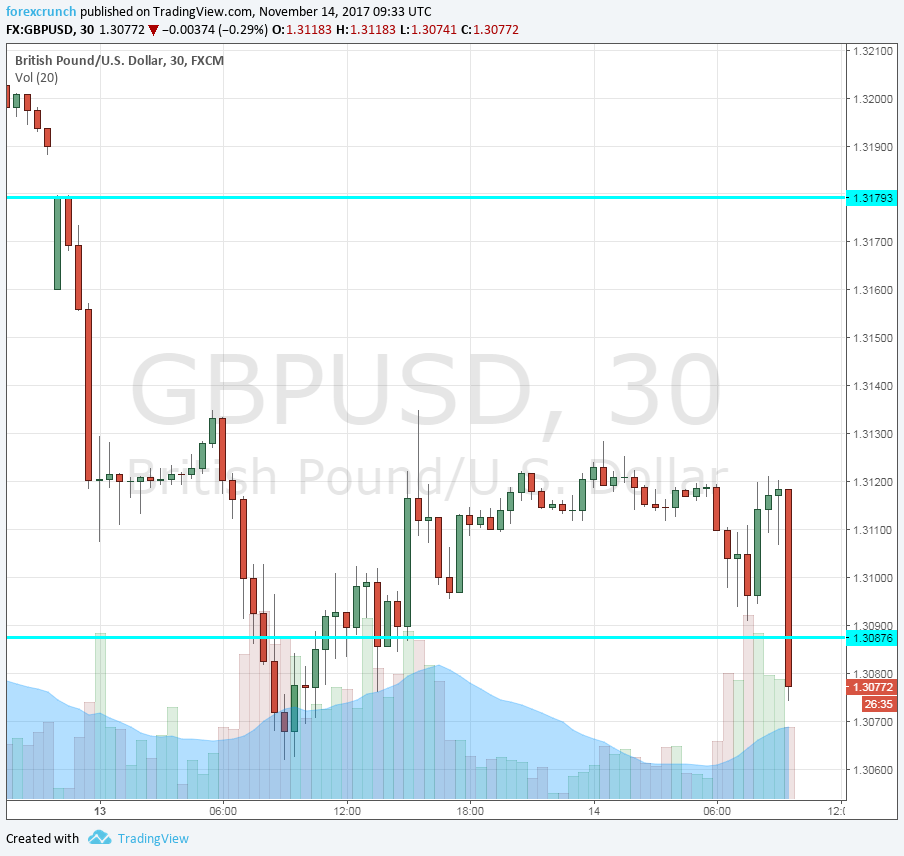

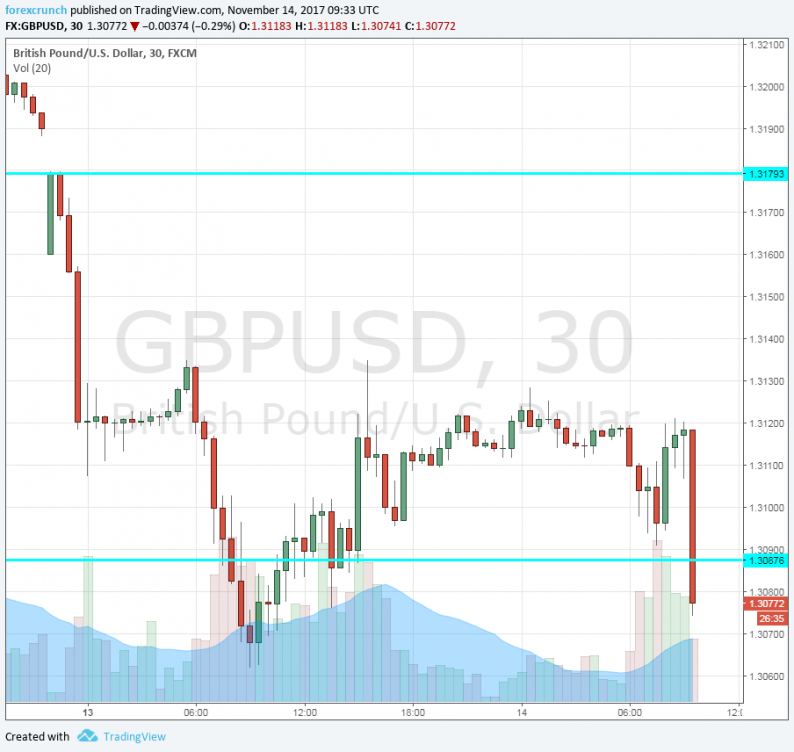

GBP/USD is falling some 30 pips from 1.3110 to 1.3080. Further support is at 1.3350.

Are the members of the Bank of England regretting the rate hike? Here is how it looks on the 30-minute pound/dollar chart:

The UK was expected to report yet another rise in headline inflation: 3.1% y/y in October against 3% in September. The Bank of England projected that inflation will peak in October and will then slide.

Core CPI carried expectations for a rise of 2.8% y/y after 2.7% beforehand. The RPI was predicted to advance to 4.1% from 3.9%. PPI Input was expected to rise by 1.1% m/m.

GBP/USD was trading around 1.1310 ahead of the publication. The pound suffered 4 different downers yesterday and it fell to a low of 1.3060, close to support at 1.3050. However, from there it recovered while remaining at the lower end of the wider 1.3030 to 1.3320 range that characterized its trading of late.

Brexit talks are stuck. The EU gave an ultimatum to the UK regarding the divorce bill. In addition, the UK government is suffering from significant infighting.

Leave A Comment