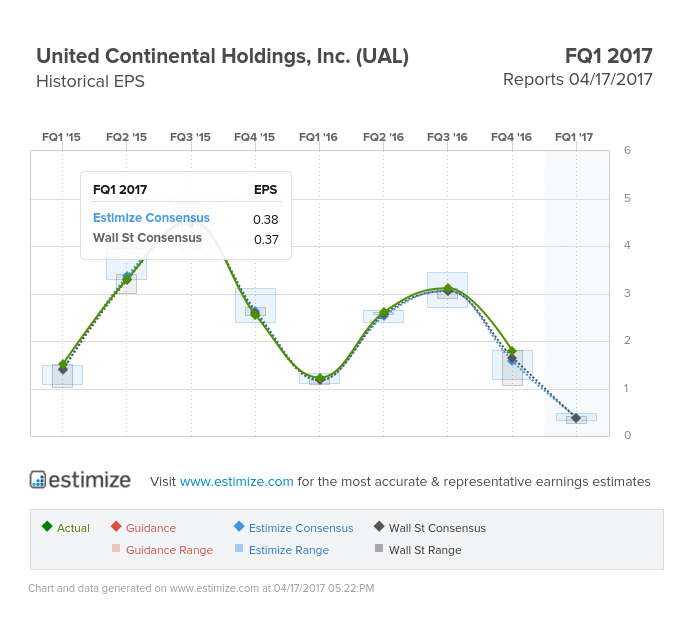

United Continental Holdings (UAL) reports April 17 after the market closes.

Key Takeaways:

Airline earnings season officially kicked off with Delta reporting this past Wednesday with better than expected earnings growth. Estimize and Wall Street were in line with EPS expectations of $0.74, with Delta beating both by 3 cents. This week, all eyes are on United Airlines’ earnings report as two controversial events have caused backlashes. It started last month when teenage girls traveling under company benefit rewards were not permitted to board an aircraft because the leggings they were wearing did not meet dress code, and then just last week another passenger on a United aircraft was forcibly removed from the plane, after refusing to be re-accommodated to a later flight.

According to United’s recent investor update, the March close-in traffic was “better than expected.” This suggests that United could beat consensus expectations for a fifth straight quarter. The update, which was released on Monday, helped assuage some investor concerns in the aftermath of the public relations fiasco. However, United’s PRASM indicator has shown no growth over the past year, which will pose a threat to earnings growth this quarter. United reports operational performance on a monthly basis. Its most recent reports declared that UAL’s March 2017 consolidated traffic (revenue passenger miles) increased 3% and consolidated capacity (average seat miles) increased 3.4% versus March 2016. Additionally, UAL’s March 2017 consolidated load factor decreased 0.3 points compared to March 2017. Overall, one can expect United to fall flat as operational performance has not improved significantly.

Leave A Comment