When a reader recently quoted me from a four-year-old post, I realized I needed to update a few of them. I’ve learned some things in the past few years and, like many of us who research retirement finance, my thinking has “evolved.”

(My wife would undoubtedly question both claims, but I refer specifically to retirement finance matters at present.)

Sometimes reading an old post is like seeing a photo of yourself from 1975 with mutton chop sideburns a la Neil Young and saying out loud, “What was I thinking?“

One such post is Unraveling Retirement Strategies: Floor-and-Upside[1], from February 6, 2014. I’ve made a few changes to reflect my updated perspective and to incorporate some of the excellent reader comments that post attracted. Specifically, I’ve become more enamored with annuities and less with TIPS ladders.

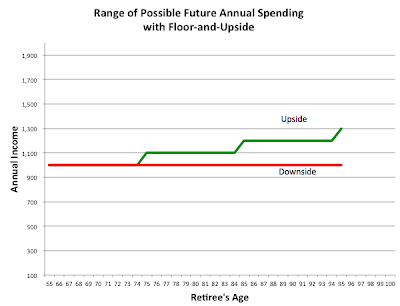

The floor-and-upside strategy for financing retirement is sometimes referred to as “safety first” and derives from The Theory of Life-Cycle Saving and Investing[1].

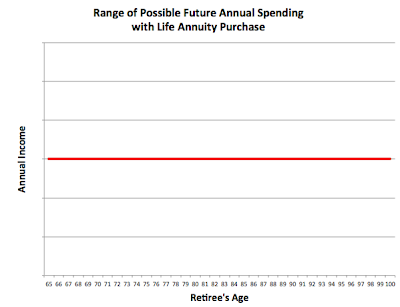

The basic idea behind floor-and-upside is that a retiree devotes some of her retirement funding assets to building a lifetime stream of income and the remainder to an investment portfolio to provide liquidity and the possibility of increasing wealth over time.

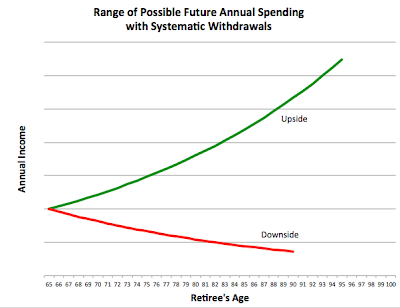

It’s important to note that growth of the upside portfolio isn’t guaranteed and, in fact, the “upside” investment portfolio may shrink over time or even be depleted prematurely (an “upside portfolio” also has downside). The “floor” is a safety net that will provide income should the upside portfolio fail. The rest of your retirement plan should ensure that having to live off the floor income alone is very unlikely.

Leave A Comment