The price of no asset can move up or down in a straight line, so why should mining stocks be any different? They have been declining relentlessly for almost 2 weeks, erasing more than 10% of their value. Sharp? Definitely. Unsustainable? Perhaps. When will the turnaround take place? It depends.

It depends on the bullish signs and confirmations that we get. The correct question to be asking now is: “Why do we need any confirmations at all?” The reply is that because the situation is tense as there are good reasons for both a turnaround in a day or two and a continuation of the decline without a meaningful correction.

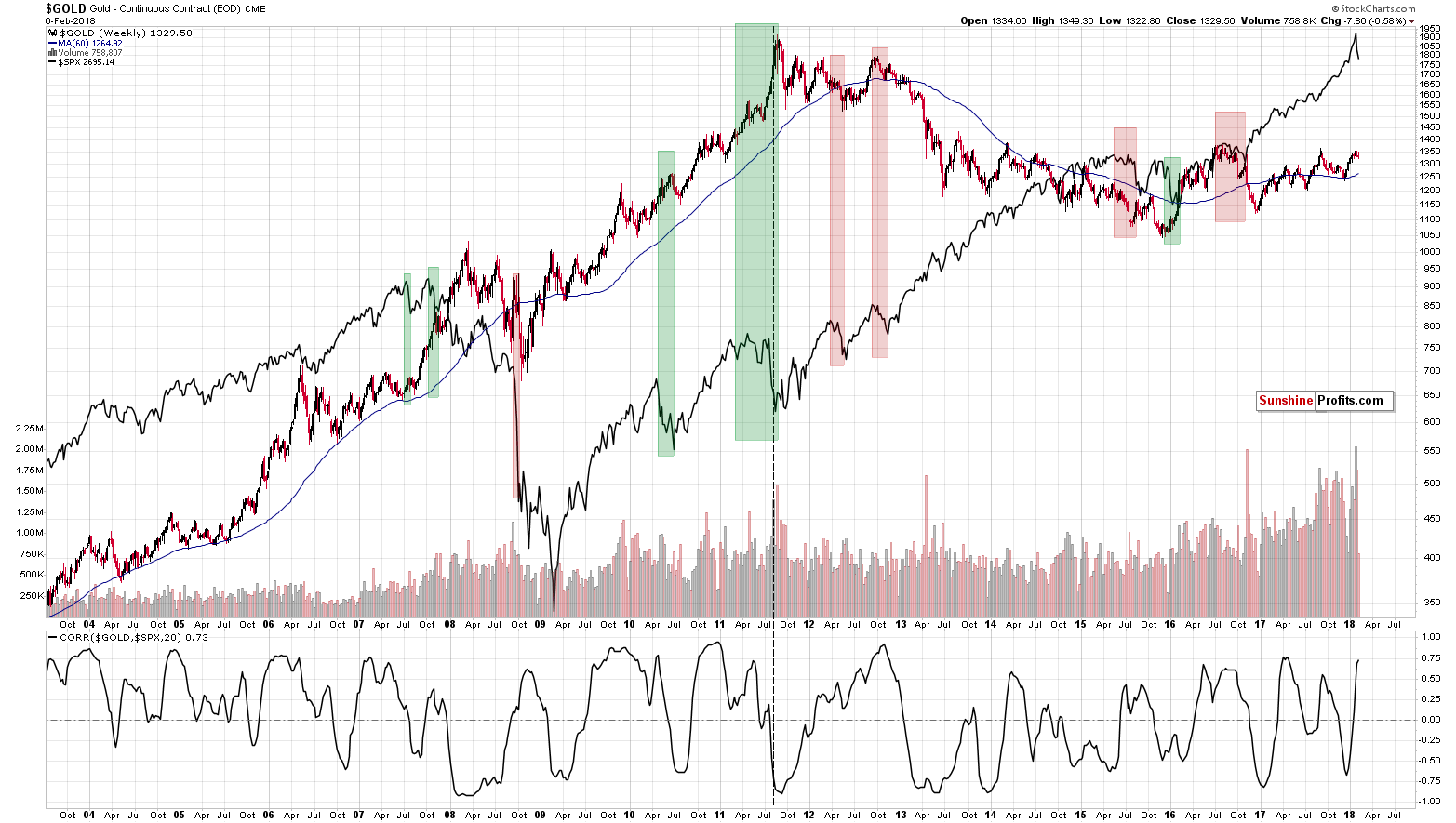

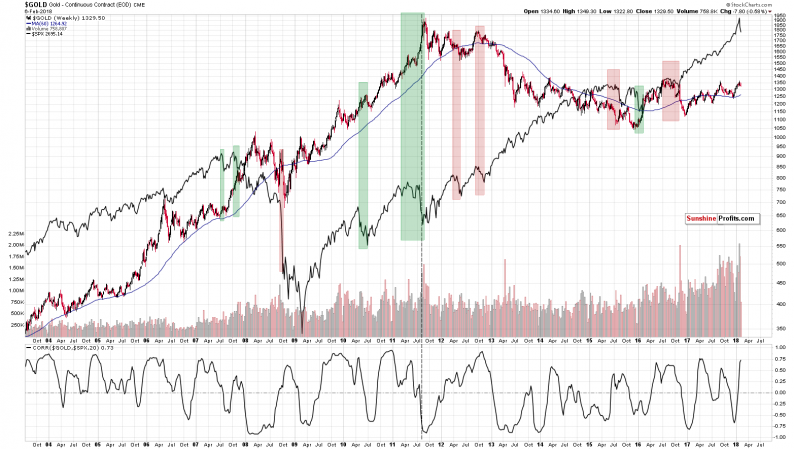

Before moving to the above details, we would like to give you an update on the gold-stock link. Let’s start with gold’s price compared to the S&P 500 Index (charts courtesy of http://stockcharts.com).

As we explained previously, there’s one thing that – right from the start – differentiates between the two kinds of reaction: stocks declining along with gold and stocks triggering a rally in gold. Autocorrelation. Autocorrelation is a fancy way of saying that what happens first makes the same reaction likely, which makes the follow-up to the follow-up likely to be the same as well – and so on. In other words, the way gold initially reacted to the decline in the S&P 500 was the way in which it kept on reacting in the following weeks and – sometimes – months.

What kind of price action did we see in the previous several days (not only yesterday)? On average, the S&P declined along with gold. So, what’s the likely impact that a declining stock market is going to have on the precious metals market? It’s likely going to be negative in the following weeks and – perhaps – months.

At this point you may correctly ask: “If that’s the case, then why didn’t gold decline on Monday?” There are several reasons as to why this was not the case.

The simplest one is that the relationship described in the previous paragraph is supposed to work on average, but it doesn’t mean that gold and the S&P will move in the same direction on every single day. The metals didn’t react by soaring higher on Monday – they moved up rather insignificantly. Plus, miners were lower anyway.

The second thing is that Monday’s session was particularly volatile – something that investors were not prepared for emotionally. Some of them had probably bought gold and silver in hope of hedgingthemselves. After the session it turned out that it was not that helpful (the S&P was down 4%, while gold was almost flat, moving higher by less than 0.5%), so the following days of the general stock market’s decline may be characterized be much smaller willingness of the investors to purchase precious metals in hope of hedging their stock portfolios.

Yesterday’s session served as a confirmation of the “on average” type of link. On Monday stocks declined severely, while gold moved a bit higher. During yesterday’s session stocks moved a bit higher, but gold declined almost $20. On average, both assets declined. The link as well as the bearish implications remain intact.

Leave A Comment