For the duration of this expansion, the Federal Reserve has continually predicted an increasing pace of inflation. While their overall rate of projections has trended somewhat lower during the last five years, they still believe inflation will be somewhat higher in the next 12 to 18 months. The data does not support their projections. The consumer price index, personal consumption expenditures deflator, the Dallas Feds 16% trimmed mean CPI index, and the Cleveland Feds median CPI reading all indicate little to no meaningful inflationary pressure in the economy as a whole.

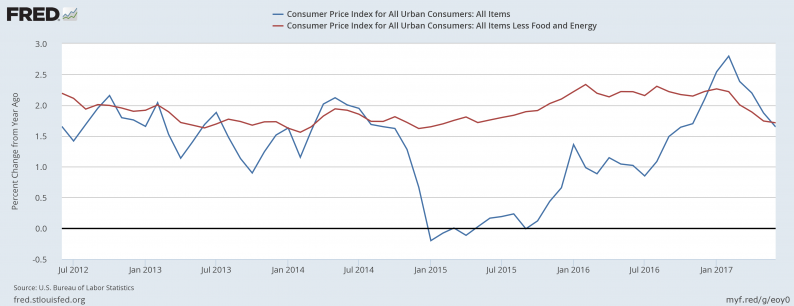

Let’s start by looking at the two most commonly referenced inflation measures: the CPI index and CPI less food and energy (sometimes referred to as core prices).

Core prices (in red above) have been remarkably consistent. They printed between two and 2.5% for all of 2016. Since the beginning of the year, they’ve trended lower. Total CPI (in blue above) was near 0% for the first half of 2015. Eight rose steadily until the beginning of 2017, eventually printing slightly above 2.5%. But it has moved sharply lower since as the just above 1.5%.

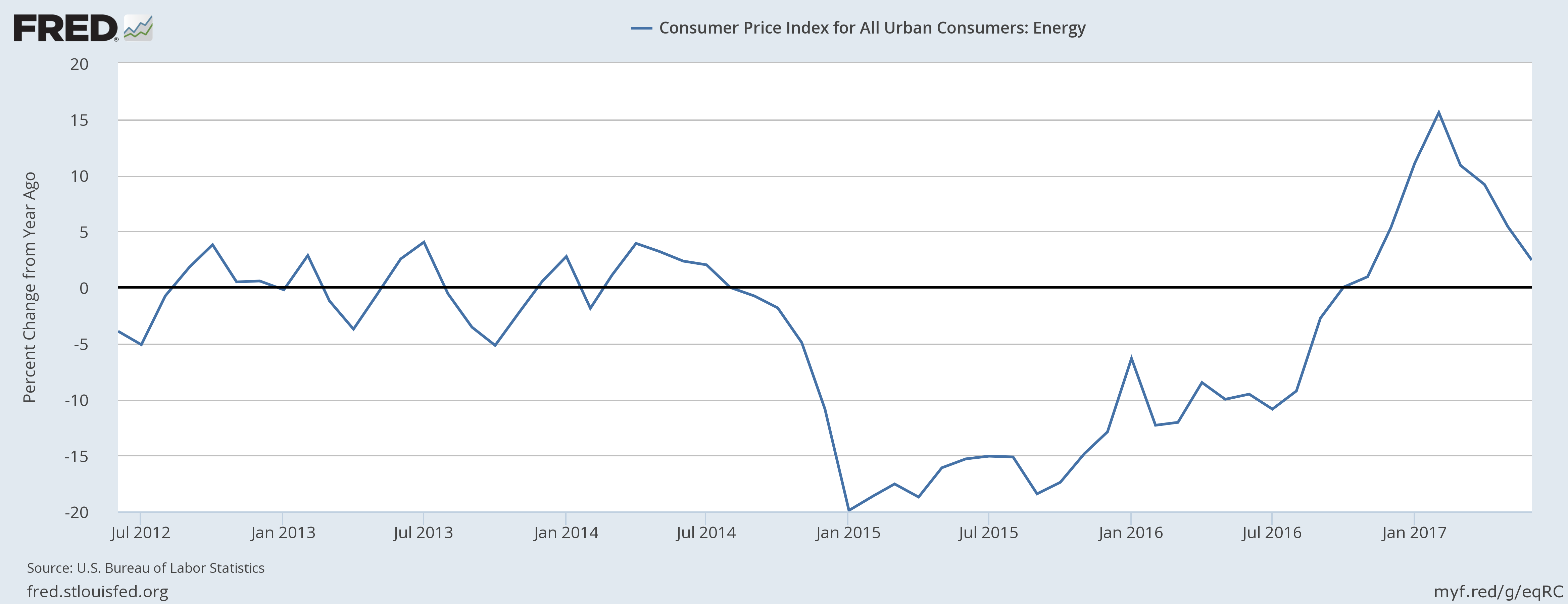

Let’s take a detailed look at both food and energy prices:

Food prices (top chart) are incredibly weak. While they were slightly above 3% at the beginning of 2015, they have been trending lower since, eventually turning negative at the end of 2016. They’ve rebounded at the beginning of this year, but are now below 1%. Energy prices (bottom chart) were negative between the fourth quarter of 2014 and the final quarter of last year. They moved higher at the beginning of this year but have since moved lower. Energy prices collapsed in late 2014 when OPEC opened the floodgates of production, hoping to drive US drillers from the market. But since then, the break-even point for frackers has dropped from ~$80.00/BBL to ~50/BBL. At current price levels, U.S. oil production is coming back online, contributing to a global supply glut. With the exception of a recent spike in wheat prices, there is little reason to believe that either food or energy prices will lead to inflationary pressures.

Leave A Comment