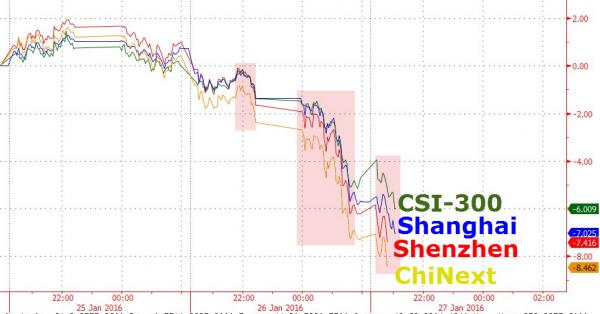

Dow futures are down 100 points and Chinese stocks are pressing new 14-month lows, extending last night’s carnage after Chinese Industrial Profits tumbled. With a dismal 4.7% drop year-over-year, led by a near 60% collapse in the mining industry, early strength (after some jawboning from Abe) gave way to fresh lows and US equity futures are also responding. Offshore Yuan refuses to drop since Xinhua wrote a 3rd hit piece against George Soros and his “speculative snap profits.”

This year is just getting uglier…

Offshore Yuan has been interfered with twice now in the last 24 hours as Xinhua unleahes its 3rd hit piece against George Soros and his speculative ilk…

So why do speculators make claims that run counter to reality? Analysts said it is because either the short-sellers haven’t done their homework or that they are intentionally trying to create panic to snap profits.

However, it seems the selling pressure is persisting no matter how hard they try to hold it…

US equity futures are also under pressure as early oil weakness coupled with AAPL’s plunge after hours was not helped by China weakness…

Leave A Comment