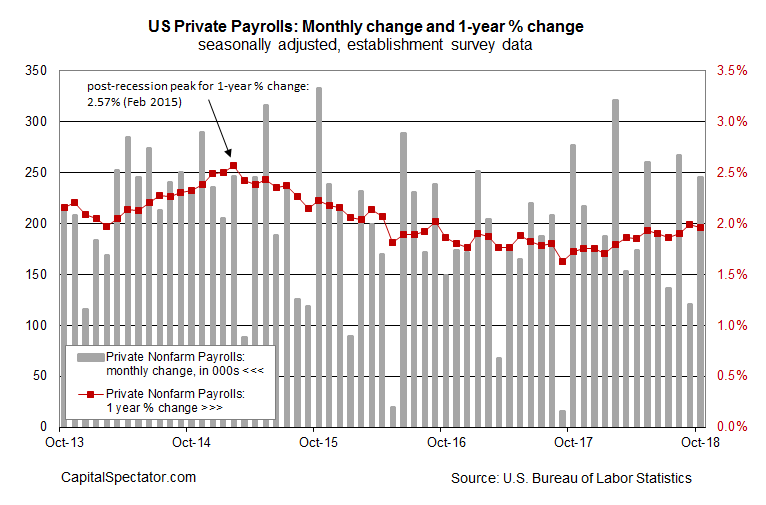

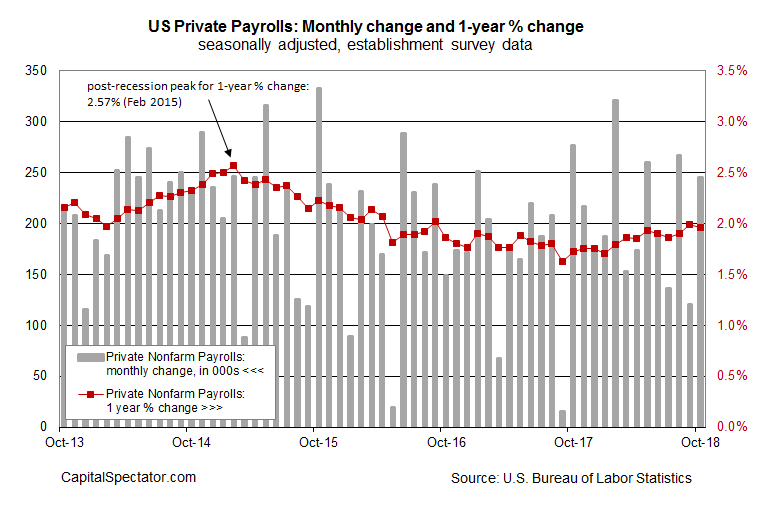

Private payrolls in the US surged 246,000 in October, according to this morning’s update from the Labor Department. The gain, which was well above the consensus forecast, marks a sharp rebound following September’s weak 121,000 rise.

Some analysts say that the latest numbers may be due to the temporary effects from hurricanes. Perhaps, but looking through the monthly volatility reaffirms that the trend remains solid, based on the year-over-year change for private-sector job creation.

For a second month in a row, payrolls at US firms grew by roughly 2.0% in annual terms. The pace for the past two months marks the strongest year-over-year trend for the labor market in two years. The key takeaway: concern that the US economy is weakening appears overblown, according to the data du jour.

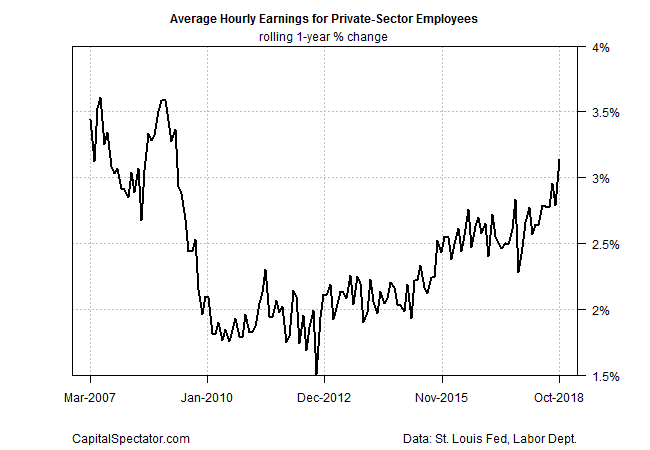

Wage growth also strengthened last month via a 3.1% annual increase — the strongest jump in nearly a decade.

Today’s figures give the Federal Reserve new reasons to argue that another interest-rate hike is prudent. Fed funds futures are currently estimating a 72% probability that the central bank will lift its target rate at the December FOMC meeting by 25 basis points to a 2.25%-to-2.50% range, according to CME data.

“The labor market is definitely healthy and we’re bringing more people into the labor force,” says Scott Anderson, chief economist at Bank of the West.

Leave A Comment