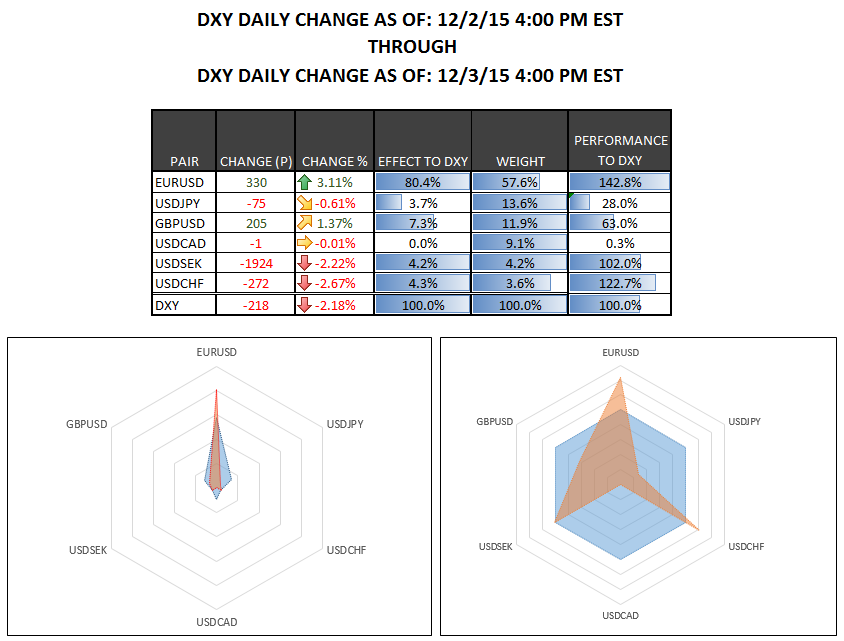

As I discussed last week the main drivers of the large move down in the US Dollar’s DXY index on Thursday were the European currency pairs with the USD/CAD and USD/JPY mostly sitting out the decline in the DXY index. The GBP/USD was certainly up on Thursday but had very much underperformed the gains that were seen in the DXY Index as a whole.

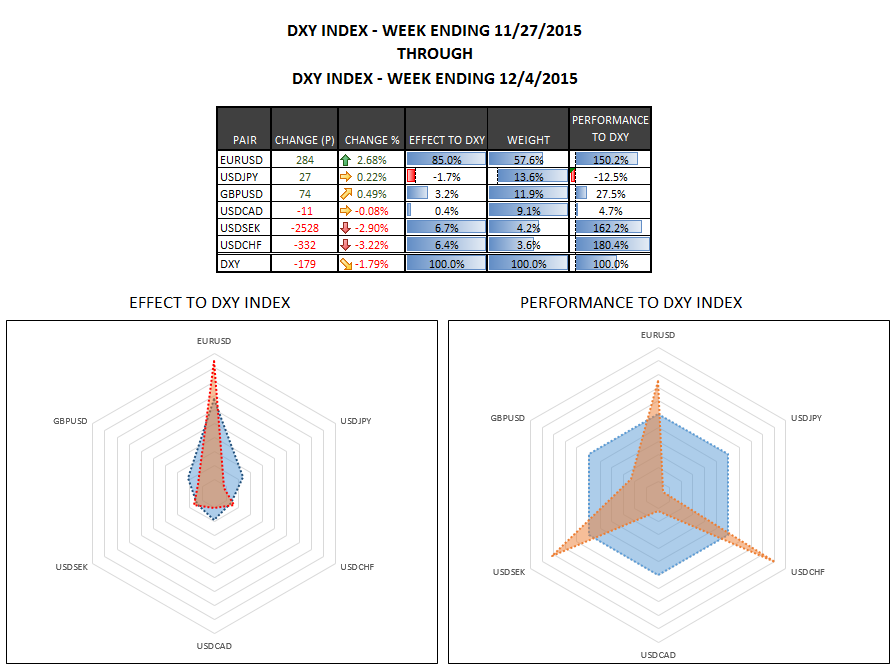

The picture is even more dramatic if we look at the weekly data which is now in. Viewing an entire weeks’ worth of data we can see that the European currency pairs accounted for over 98% of the losses in the DXY Index for the week with the EUR/USD accounting for over 85% of the indexes drop. Additionally not only did the USD/JPY and USD/CAD currency pairs end the week fairly flat they had very little movement throughout the entire week as well trading in a very tight range.

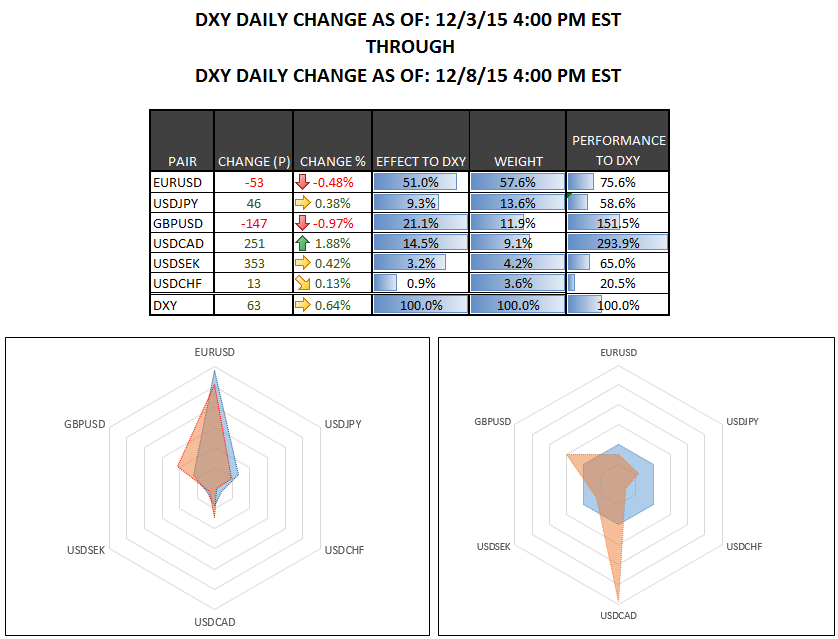

Now looking at the action in the component pairs since the close of trading on Thursday what we notice is that we have a much more normalized and less divergent look to how the individual pairs are moving in regards the DXY Index as a whole.

Interestingly the USD/CAD which did not participate in the DXY Index’s drop at all and traded sideways during the entire drop of is now heavily outperforming the rest of the index. In fact the USD/CAD currency pair looks to have broken out to the upside and could potentially see levels as high as 1.3962 -1.4177 or 3% – 5% higher from current levels before topping.

Next looking at the GBP/USD we can see that this pair has now retraced much of the gains from Thursday finally finding some support at the 76.4 retrace level on Tuesday followed by a large move higher on Wednesday. This deep retrace is suggesting that it is likely that this pair will yet see another low to complete the larger degree pattern before heading higher in conjunction with the larger degree correction the US Dollar.

The last of the individual pairs that we will review is the EUR/USD. At the time of this writing the EUR/USD is still trading now trading over the high that was made on Thursday after a more that 400 pip spike up off of the 1.0538 lows. Should the EUR/USD be able to hold under the under the 1.2367 resistance level then it is still possible that the EUR/USD will see another low thus putting additional pressure on the DXY Index to move back higher prior to starting its own larger degree correction. Alternatively a move over the 1.2367 resistance level would be the first warning sign that we have made a larger degree bottom in the EUR/USD thus making it unlikely that the DXY Index would move directly higher.

Leave A Comment