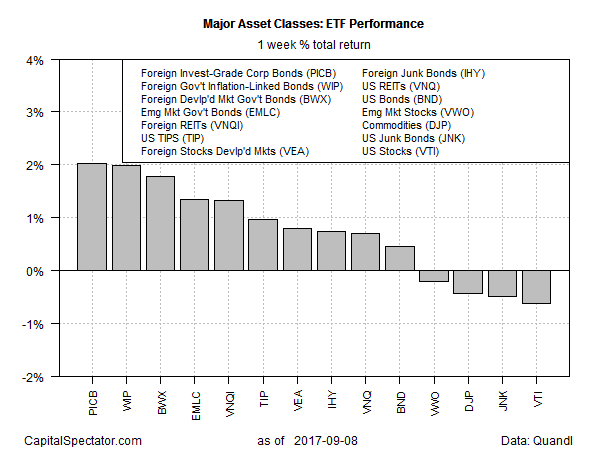

The US Dollar Index last week slumped to its lowest level in over two-and-a-half years, boosting returns in foreign bonds. Non-dollar corporate bonds topped the performance list among the major asset classes, based on a set of exchange traded products. Notably, the top-four market performers for last week are offshore fixed-income funds.

PowerShares International Corporate Bond Portfolio (PICB) led the field in the shortened four-day trading week through Friday, Aug. 8. The ETF increased 2.0%, rising to a two-year high.

Last week’s biggest laggard: US equities. Vanguard Total Stock Market (VTI) slipped 0.6%, its first weekly setback in three weeks.

One reason for the dollar’s weakness lately: renewed expectations that the Federal Reserve won’t raise interest rates again this year. Several factors are driving the forecast, including a run of damaging weather across large southern states in the US. “Economic disruptions caused by a back-to-back pummeling from hurricanes in the United States may just seal the deal for the Federal Reserve to hold interest rates intact for the rest of this year,” CNBC reports via interviews with analysts.

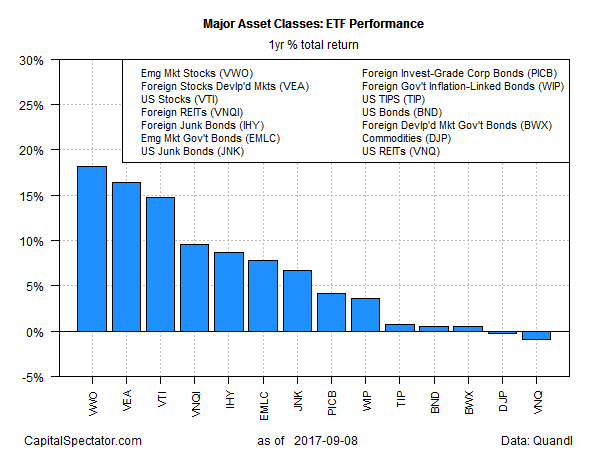

For one-year returns, stocks generally continue to hold the lead. At the front of the horse race: emerging-markets equities. Vanguard FTSE Emerging Markets (VWO) is currently ahead by 18.2%.

In second place for one-year results among the major asset classes: Vanguard FTSE Developed Markets (VEA), posting a 16.4% total return through Friday’s close.

The bottom performer for the trailing one-year period: US real estate investment trusts (REITs). Vanguard REIT (VNQ) is down 0.9% vs. its year-earlier price.

Leave A Comment