The US Dollar launched a dramatic recovery against the major currencies in late Asian trade, with prices on pace to deliver the largest advance in three weeks. The move tracked a jump in front-end US Treasury bond yields, hinting that a pickup in Fed rate hike speculation may be the catalyst at work. US President Trump’s move to weaken the Dodd-Frank bank regulation framework may be behind the move.

Most critically, the Dodd-Frank bill adopted after the 2008-09 crisis aimed to improve the ability of the financial system to absorb future shocks by asking US banks to maintain larger capital cushions. Relaxing the law’s requirements would allow US lenders to deploy a larger share of their reserves. This may translate into an inflationary liquidity swell that forces the Fed into a steeper tightening cycle.

A number of other currencies also found support, though none proved as buoyant as the greenback. The Japanese Yen rose as most Asian stock exchanges slumped, boosting demand for the standby anti-risk unit. The Aussie Dollar gained as the RBA poured cold water on lingering rate cut bets. The New Zealand Dollar jumped after an estimate of businesses’ two-year inflation expectations hit a 1.5-year high.

Looking ahead, a relatively quiet economic data docket seems to present few roadblocks to established momentum, hinting that the buck may have scope to continue marching upward. The disruptive potential of news-flow coming from the White House should not be minimized however. For example, a stray headline that hints at more modest fiscal stimulus than previously expected may trigger a swift reversal.

Have a question about the markets? Sign up for a Q&A webinar and ask it live!

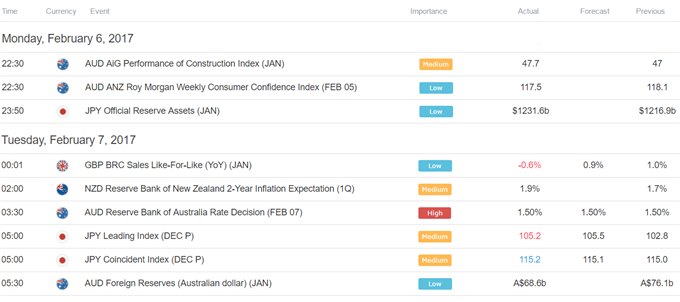

Asia Session

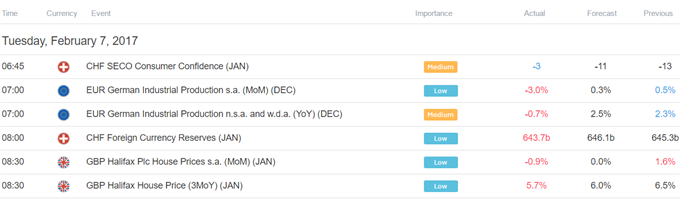

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Leave A Comment