The outlook for the global economy is suffering these days, but there’s still no clear sign that the deceleration in macro activity has infected the US. Based on the latest numbers for October, the broad trend for the US remains distinctly positive. A diversified mix of economic and financial indicators continues to reflect growth through last month. But there are clouds on the horizon. Stagnation in Europe, recession in Japan, and slowing growth in China collectively pose a threat to America’s positive momentum — a threat that may take a bite out of US activity at some point. But for the moment, the numbers for the US overall reflect a clear bias for expansion.

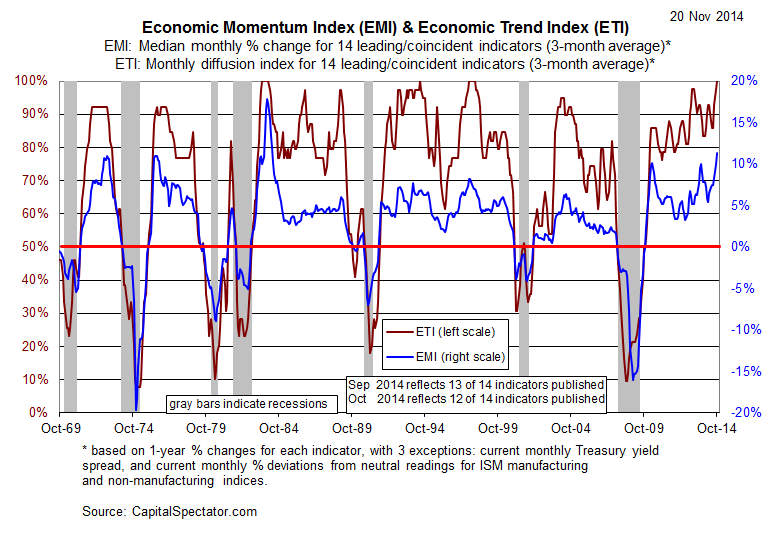

Using a methodology outlined in Nowcasting The Business Cycle: A Practical Guide For Spotting Business Cycle Peaks, economic and financial trends suggest that recession risk for the US remains low as of October. The Economic Trend and Momentum indices (ETI and EMI, respectively) are still at levels that equate with expansion. The current profile of published indicators for last month to date (12 of 14 data sets) for ETI and EMI reflect solidly positive trends.

Here’s a summary of recent activity for the components in ETI and EMI:

Aggregating the data into business cycle indexes continues to show a positive trend. The latest numbers for ETI and EMI indicate that both benchmarks are well above their respective danger zones: 50% for ETI and 0% for EMI. When the indexes fall below those tipping points, we’ll have clear warning signs that recession risk is elevated. For now, however, there’s still a sizable margin of safety between current values for October (100.0% for ETI and 11.4% for EMI) and the danger zones.

Translating ETI’s historical values into recession-risk probabilities via a probit model also suggests that business cycle risk remains low for the US. Analyzing the data with this methodology implies that the odds are virtually nil that the National Bureau of Economic Research (NBER) — the official arbiter of US business cycle dates — will declare last month as the start of a new recession.

Leave A Comment