The Conference Board reported the LEIs and CEIs this week: LEIs increased .6% while CEIs rose .2%.The only negative LEI component was the ISM manufacturing new orders index, which subtracted .05% from the total number.But two other leading manufacturing numbers were positive.Perhaps best of all, the average workweek of production workers added to the number. Three of four CEI components expanded; only industrial production contracted.

Housing starts declined 11% M/M and 1.8% Y/Y.The primary reason for the drop was the multi-family sector, as this chart from Calculated Risk shows:

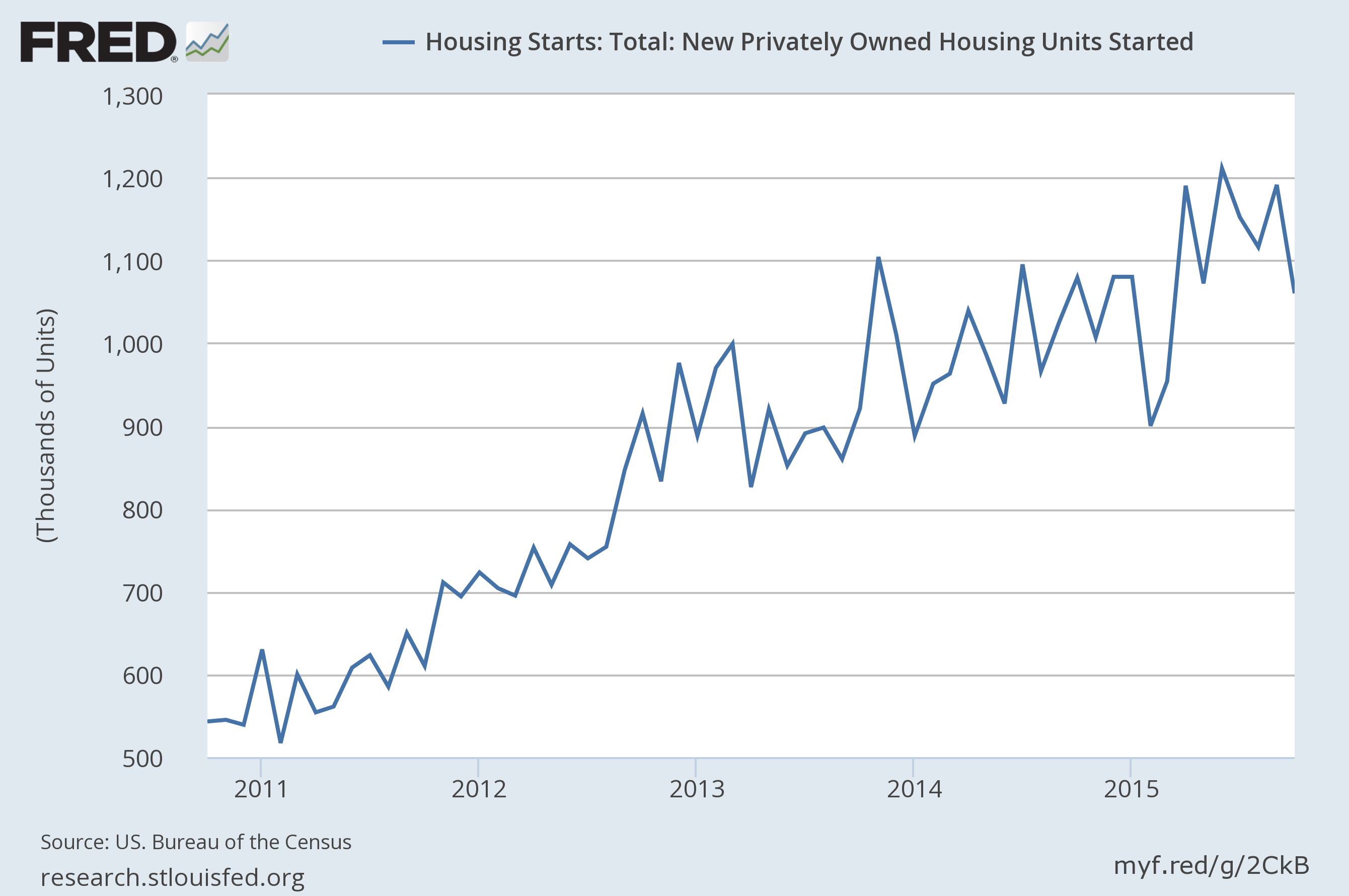

The composite starts number (which combines one and multi-family dwellings) printed between ~1.1 and 1.2 million for the last 5-6 months:

However, permits increased 4.1% M/M, which is strong precurser of starts:

Overall, the housing news remains positive. Permits – a leading indicator – continue to increase. The decline in starts follows large increases over the last 2-3 months, meaning the drop is simply a natural contraction after rapid expansion.

Industrial production declined .2%, which is the third decline in the last six months. Mining dropped 1.5%, which is also the third such decline over the last half year.

This weakness is a continued development caused by a combination of the strong dollar, weaker emerging economies and decline in oil sector capital spending.

The Atlanta Fed’s GDP model predicts 4Q GDP of 2.3%; Moody’s is a bit higher at 2.4%, while the Cleveland Fed’s interest rate curve model is 1.9%.And the Atlanta Fed’s recession predictor is 13.3%.

Economic Conclusion: The US economy continues to expand at a “moderate” pace. While recent housing news has been slightly weaker, it’s most likely a natural decline after a sharp increase a few months ago. And the increase in permits points to continued building.Industrial production continue to suffer from the strong dollar, weak oil sector and slowing emerging economies.But, the general 4Q GDP projections continue pointing towards growth right around 2%.

Leave A Comment