Recent market and statistical weakness has led to increased discussion of a possible US recession.In this column, I will argue that instead of a recession, we’re facing a situation similar to the mid-1980s, where the economy also experienced slowdown caused by high oil prices, a strong dollar slowdown and weak oil sector.But there is insufficient weakness – largely thanks to continued housing market strength and recent wage growth – for a recession to occur.

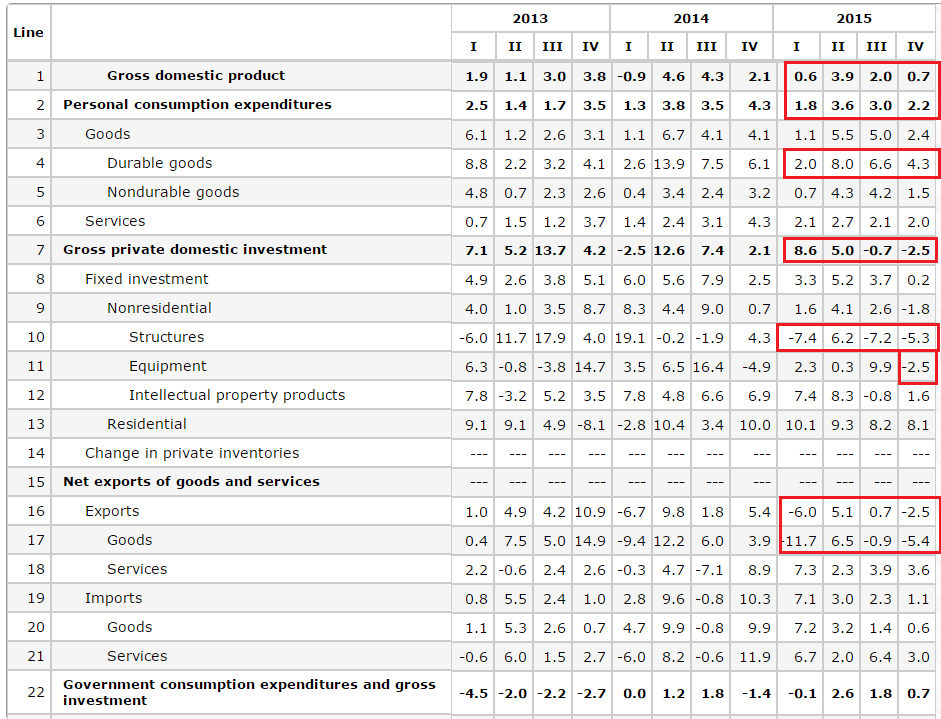

Let’s start with the Q/Q growth numbers:

Between 1Q15-4Q15, personal consumption expenditures (PCEs) fluctuated between .6% and 3.9% Q/Q growth. Durable goods purchases varied between 2%-8% growth – an encouraging pace. And service spending was constant, with numbers seesawing between 2%-2.7%. Investment is where problems emerge. Non-residential structural spending contracted in 3 of the last 4 quarters; spending on equipment was weak in 2Q14 (.3% increase) and contracted in 4Q15. But residential investment grew strongly in all four quarters.And finally, we have exports, which contracted in 2 of the last four quarters.The Q/Q numbers show modest growth, with the weak oil/gas extraction market and strong dollar hurting growth.

Let’s turn to the Y/Y numbers for the same figures:

Topline PCE growth recorded levels between 2.6%-3.3% for the last 4 quarters – a decent pace of growth. Consumer durable goods expenditures were very strong, vacillating between 5.2% and 7.3%.As with the Q/Q figures, Y/Y business investment numbers were weak; non-residential structural investment declined in 3 of the last 4 quarters. But residential spending increased at a solid pace. And exports declined in the 2H15.So, like the Q/Q numbers, we again see evidence of industrial and export weakness.

The US LEIs and CEIs help to place this information in business cycle context. First is this observation of the LEIs from the latest release:

The Conference Board LEI for the U.S. decreased in December, with large negative contributions from the ISM® new orders index and building permits more than offsetting the large positive contribution from the yield spread. In the second half of 2015, the leading economic index increased 0.7 percent (about a 1.3 percent annual rate), much slower than the growth of 2.0 percent (about a 4.0 percent annual rate) during the first half of the year. In addition, the strengths among the leading indicators have become less widespread and are now only balanced with the weaknesses.

Leave A Comment