Market Analysis

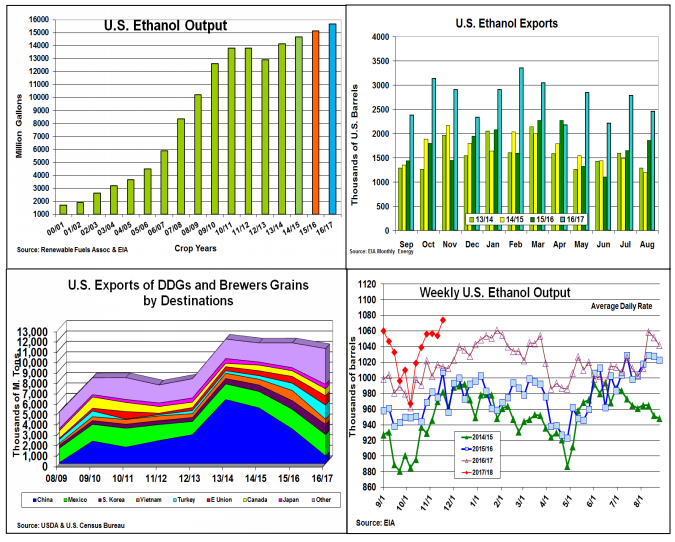

After the latest weekly Energy Information Agency (EIA) ethanol production update revealed an all-time high of 1.08 million average daily barrels of output (453.6 million gallons) from US operating bio-refineries, this warrants a focus on this important corn demand. For the 4th consecutive crop year and 49 out of last 50 months since September 2013, US ethanol output has produced a higher yearly amount of bio-fuel than the same month the previous year. During 2016/17 crop year, US total output of fuel ethanol was 15.6 billion gallons, a 3.3% rise over the previous year. With the first two months of this crop year already averaging near 3.5% higher output on a combination of a record domestic demand and on ongoing strong overseas demand, the upcoming 2017/18 crop year should continue this strong industrial corn demand.

US ethanol exports have been at record levels 11 out of last 12 months during 2016/17 crop year because of expanding world environmental demand, a weaker dollar and a competitive price vs. S. American ethanol. This has resulted in 56% yearly jump in overseas shipments to 32.5 million barrels or 1.365 billion gallons. Given Beijing statements about cleaning up their urban smog problems, optimism about further exports gains in 2017/18 exist. However, Chinese infrastructure problems will limit their expansion plans, short-term. China’s decision in 2015 to impose a 33% anti-dumping tariff against US DDG imports has cut our shipments dramatically by 37.7% last year and 88% in 2016/17 crop year to the lowest level since China began importing this by-product in 2008/09. Overall, DDG exports slipped 4.7% during 2016/17, but significant jumps by Turkey, EU and other Asian buyers (S. Korea, Thailand, Indonesia and Japan) compensated for China’s 2.6 mmt drop in imports. Beijing recently dropped its VAT fee on DDG imports, but the anti-dumping 33% tariff still seems to be in force.

What’s Ahead

Given this year’s strong first quarter US ethanol production and our current price advantage in the world biofuels markets vs. sugar-based ethanol, this industrial demand for corn appears quite strong for the upcoming 2017/18 crop year. This early strength should even prompt the USDA to up its yearly outlook for ethanol production by 50 million bu. in December’s corn balance sheet revisions.

Leave A Comment