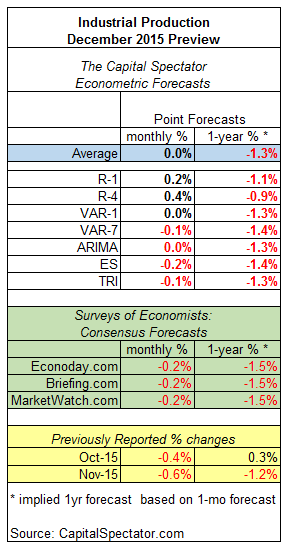

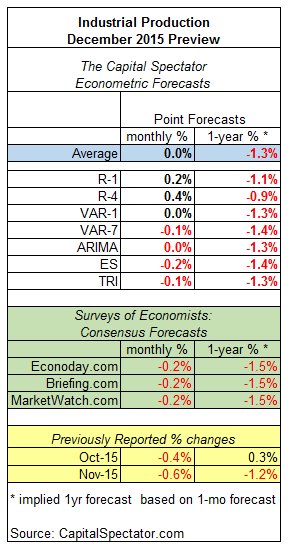

US industrial production is expected to post no change in tomorrow’s December report vs. the previous month, according to The Capital Spectator’s average point forecast for several econometric estimates. The prediction reflects relative improvement in comparison with the previously reported 0.2% decline in November.

The Capital Spectator’s average forecast is above three recent surveys of economists that anticipate another dip in output for December. Note, however, that all the estimates in the table below project that industrial output will continue to contract on a year-over-year basis. If so, the annual decline will mark the second month in a row that output has decreased vs. the year-earlier level–the first run of back-to-back losses since the last recession.

Here’s a closer look at the numbers, followed by brief summaries of the methodologies behind the forecasts that are used to calculate The Capital Spectator’s average prediction:

R-1: A linear regression model using the ISM Manufacturing Index to predict industrial production. The historical relationship between the variables is applied to the more recently updated ISM data to project industrial production. The computations are run in R.

R-4: A linear regression model using four variables to project industrial production: US private payrolls, an index of weekly hours worked for production/nonsupervisory employees in private industries, the ISM Manufacturing Index, and the stock market (Wilshire 5000). The historical relationships between the variables are applied to the more recently updated data to project industrial production. The computations are run in R.

VAR-1: A vector autoregression model using the ISM Manufacturing Index to predict industrial production. VAR analyzes the interdependent relationships of the variables through history. The forecasts are run in R using the “vars” package.

Leave A Comment