Sales of new homes dropped by 10.4% to 536K in December, down from an upwards revised 598K in November. This is quite a significant miss. The CB Leading Index rose by 0.5% as predicted.

The US dollar has been on the mend coming into the release. Will this plunge in new home sales change the picture?

The US was expected to report an annualized level of new home sales at 588K, a 1% drop from the 592K level seen in November (before revisions). At the same time, the CB Leading Index carried expectations for a rise of 0.5% after remaining flat beforehand.

Sales of new homes matter more to the economy despite their smaller share of overall transactions. Each sale of a new property creating a cascading effect of further economic activity: roads, schools, etc.Earlier this week, existing home sales came out as expected.

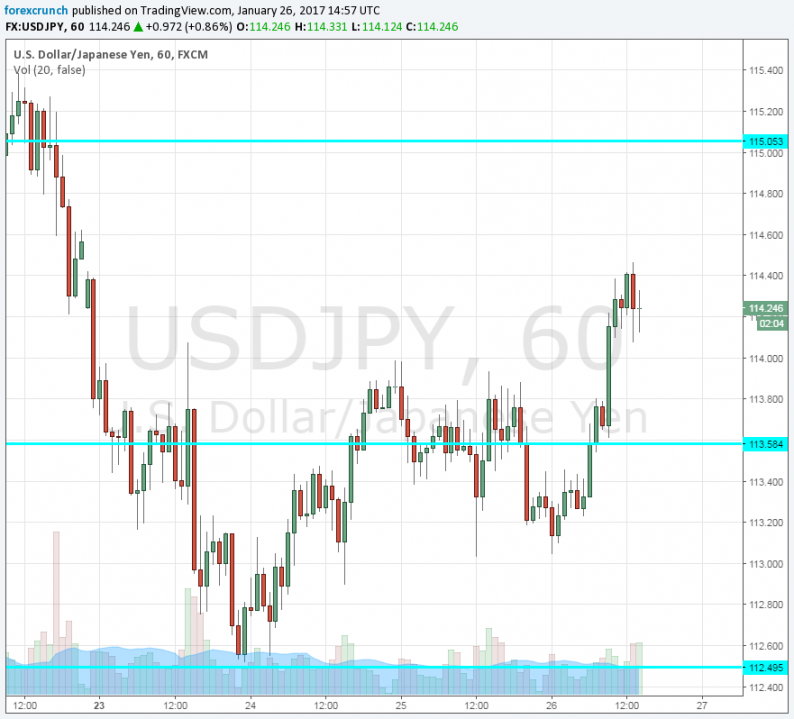

The US dollar was reasserting itself after a weak start to the week. EUR/USD slipped under 1.07, USD/JPY topped 114 and GBP/USD dropped under 1.26 despite an excellent GDP report from Britain.

Earlier, Markit’s flash services PMI surprised to the upside with 55.1 points against 54.4 predicted. On the other hand, jobless claims disappointed with a jump to 259K. This did not stop the greenback comeback.

The most important release of the week is scheduled for tomorrow: the initial GDP report for Q4.

Leave A Comment